WB Excise Online | WB Excise License Application Form | BEVCO Portal | West Bengal Liquor License at excise.wb.gov.in

A liquor license is a legal document that allows a company to sell alcoholic beverages in a certain location. The state’s Excise Department is in charge of issuing liquor licenses. Without a valid state license, it is illegal to make, distribute, or sell intoxicating alcohol. The procedure for obtaining a West Bengal liquor license is detailed in this article. The official website for obtaining a license is excise.wb.gov.in

The state government has enacted many rules and regulations under the Bengal Excise Act 2012, making it mandatory for restaurants, hotels, and clubs to obtain a liquor license. The procedure for obtaining a West Bengal liquor license is detailed in this article.

Table of Contents

West Bengal Liquor License at excise.wb.gov.in

The Excise Directorate is one of the most important revenue-generating departments in the state. WB Excise Directorate i.e. excise.wb.gov.in is a part of the Finance Department of the Government of West Bengal. The Excise Directorate’s mission is to enforce regulations governing the manufacture, production, possession, distribution, transportation, supply, sale, and purchase of liquor and other intoxicants.

The Directorate works to meet the dual goals of limiting the manufacture, supply, and distribution of illicit/counterfeit/spurious liquor and/or non-duty paid intoxicants while also maximizing the State’s revenue potential.

excise.wb.gov.in Liquor License Eligibility Criteria

In order to apply for a liquor license in West Bengal at the official website i.e. excise.wb.gov.in, the applicant must meet the following requirements:

- The individual must be at least twenty-one years old.

- The individual must be a citizen of India or a Person of Indian Origin (in the case of individuals the application can be made by a single individual or multiple individuals jointly).

- Only those firms that are eligible are regulated by the Indian Partnership Act, 1932.

- Only those companies are eligible which is regulated by the Companies Act, 1956.

- A society that is registered under the West Bengal Societies Registration Act, 1961 or the West Bengal Co-operative Act, 1983

The following are some of the circumstances under which an individual is unable to seek a liquor license in West Bengal.

- A person who has been convicted of a non-bailable offense by a criminal court.

- An existing license holder who has broken his license’s terms and restrictions.

- A person who owes the State Government excise revenue but has not paid it.

- A person who is directly or indirectly involved in the manufacture or sale of any intoxicant in a foreign country or in a West Bengal state bordering on it.

Aatmanirbhar Bharat Rozgar Yojana

West Bengal Liquor License Types

A liquor license can be obtained by anyone who meets the following criteria. They are as follows:

- Temporary License

- Regular License

Temporary License

The following types of temporary licenses have a six-month validity period.

- Restaurant-cum-Bar

This license authorizes the retail sale of foreign liquor for consumption on the premises of any restaurant or bar.

- Hotel-cum-Restaurant-cum-Bar

This license allows for the retail sale of foreign liquor on the premises of any hotel, restaurant, or associated bar.

- Hotel-cum-Bar

This license allows for the retail sale of foreign liquor for consumption on the grounds of any hotel or bar.

It should be noted that applicants can seek additional bar licenses when applying for the categories listed above of temporary licenses. Under such circumstances, all additional bars must be explained in detail in the Site Plan that must be presented at the time of application.

Regular License

The following categories are eligible to apply for regular licenses.

- License for the retail sale of foreign liquor for consumption on the premises of a club, theatre, Railway refreshment room, canteen, steamer, customs airport, Dak-bungalow, dining car, or any other place of public resort and enjoyment with an accompanying bar.

- Existing Departmental Stores with a minimum floor size of 1,500 square feet and departments for the retail sale of various commodities are eligible for a license to sell beer, wine, and low alcoholic beverage (LAB) for consumption off the premises.

Minimum Requirements for Site Plan

The layout of the site, restrooms, bar counters, seating arrangements, main entrance, foreign liquor shop or go down, kitchen, and other items should all be included in the site design for the categories stated above, such as Hotel-cum-Restaurant-cum-Bar, Restaurant-cum-Bar, and Hotel-cum-Bar. The applicant and the landlord or owner of the premises should both sign the document.

Fee Applicable for Liquor License at excise.wb.gov.in

The following are the fees for various categories of liquor licenses and site locations in West Bengal:

For Restaurant-cum-Bar License

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Rs. 5,000 | Rs. 3,00,000 | Rs. 1,00,000 | Rs. 20,000 |

| Municipal Corporation Area | Rs. 25,000 | Rs. 20,000 | Rs. 6,00,000 | Rs. 2,00,000 | Rs. 50,000 |

| Municipal / Notified Area | Rs. 12,000 | Rs. 10,000 | Rs. 4,50,000 | Rs. 1,50,000 | Rs. 40,000 |

For Hotel-cum-Restaurant-cum-Bar License that are Below 3-Star Category Hotel

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Rs. 5,000 | Rs. 6,00,000 | Rs. 2,00,000 | Rs. 30,000 |

| Municipal Corporation Area | Rs. 25,000 | Rs. 20,000 | Rs. 10,00,000 | Rs. 3,33,334 | Rs. 70,000 |

| Municipal / Notified Area | Rs. 12,000 | Rs. 10,000 | Rs. 8,00,000 | Rs. 2,66,667 | Rs. 50,000 |

For Hotel-cum-Restaurant-cum-Bar License that are Below 4-Star Category Hotel

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Rs. 5,000 | Rs. 12,50,000 | Rs. 4,16,667 | Rs. 50,000 |

| Municipal Corporation Area | Rs. 25,000 | Rs. 20,000 | Rs. 18,00,000 | Rs. 6,00,000 | Rs. 1,00,000 |

| Municipal / Notified Area | Rs. 12,000 | Rs. 10,000 | Rs. 15,00,000 | Rs. 5,00,000 | Rs. 80,000 |

For Hotel-cum-Restaurant-cum-Bar License that are 5-Star or Above Category Hotel

| Location of the Site | Non-refundable application fee | The monthly nonrefundable fee for a temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Rs. 5,000 | Rs. 15,00,000 | Rs. 5,00,000 | Rs. 15,00,000 |

| Municipal Corporation Area | Rs. 25,000 | Rs. 20,000 | Rs. 25,00,000 | Rs. 8,33,334 | Rs. 15,00,000 |

| Municipal / Notified Area | Rs. 12,000 | Rs. 10,000 | Rs. 20,00,000 | Rs. 6,66,667 | Rs. 15,00,000 |

For Hotel-cum-Bar License

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Rs. 5,000 | Rs. 6,00,000 | Rs. 2,00,000 | Rs. 30,000 |

| Municipal Corporation Area | Rs. 25,000 | Rs. 20,000 | Rs. 10,00,000 | Rs. 3,33,334 | Rs. 70,000 |

| Municipal / Notified Area | Rs. 12,000 | Rs. 10,000 | Rs. 8,00,000 | Rs. 2,66,667 | Rs. 50,000 |

For Retail Wine, Beer, and Low Alcoholic Beverage (LAB) License for Consumption off the Premises from Existing Departmental Stores

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Nil | Rs. 40,000 | Rs. 13,334 | Rs. 15,000 |

| Municipal / Notified Area | Rs. 12,000 | Nil | Rs. 60,000 | Rs. 20,000 | Rs. 30,000 |

| Municipal Corporation of Siliguri, Kolkata, and Howrah Area | Rs. 25,000 | Nil | Rs. 1,50,000 | Rs. 50,000 | Rs. 60,000 |

| Other Municipal Corporation Area | Rs. 25,000 | Nil | Rs. 1,20,000 | Rs. 40,000 | Rs. 40,000 |

A retail foreign liquor license for consumption on the premises of any existing club,theatre, customs airport Dak-bungalow, dining car, canteen (except canteen for Defence Personnel), Railway refreshment room, steamer, or public resort place, entertainment, and attached bar:

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for a temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Nil | Rs. 3,00,000 | Rs. 1,00,000 | Rs. 20,000 |

| Municipal Corporation Area | Rs. 25,000 | Nil | Rs. 6,00,000 | Rs. 2,00,000 | Rs. 50,000 |

| Municipal / Notified Area | Rs. 12,000 | Nil | Rs. 4,50,000 | Rs. 1,50,000 | Rs. 40,000 |

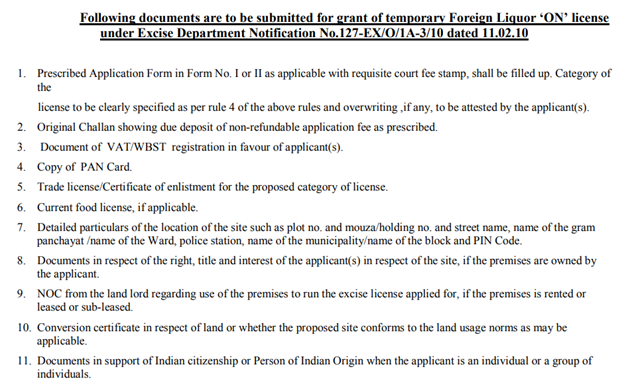

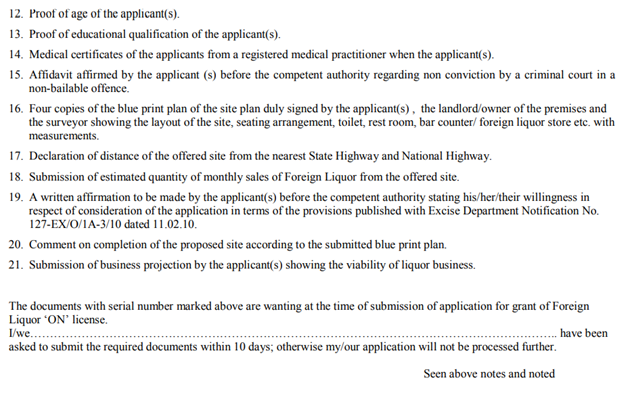

West Bengal Liquor License Documents Required

Below is the required document for applying for a West Bengal liquor license on the official website excise.wb.gov.in

Documents are to be submitted for grant of temporary Foreign Liquor ‘ON’ license under Excise Department are:

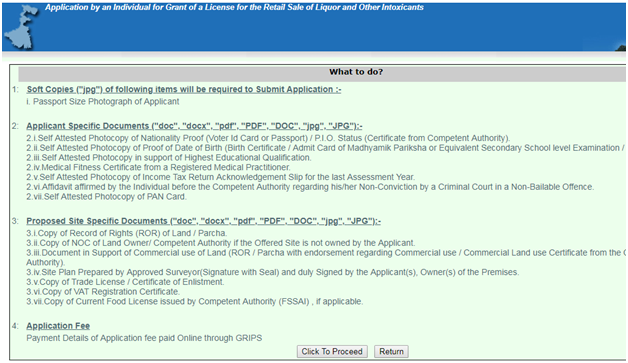

Application Process for West Bengal Liquor License

Follow the steps outlined below to apply for a West Bengal liquor license at the official website i.e. excise.wb.gov.in

- Visit the official website of Excise directorate i.e excise.wb.gov.in

- On the home screen and click on “Apply for new excise license.”

- From the citizen corner, select “Prepare application.”

- Now there are number of options available for application type select your type of application.

- After selecting the application type, the instruction page will open. Click to proceed button.

- Enter your mobile phone number, and an OTP will be issued to that number.

- The page will be forwarded to the online application form after entering the OTP.

Application for a New License (Application for a New License)

- Complete the application form with all required information and upload the scanned documents.

- The candidate must make an online payment after completing the application.

- Make an online payment

- The applicant will receive an acknowledgement as a confirmation of payment.

- The license will be verified by the appropriate authority and will be issued to the applicant.

Contact

For further queries contact:

- Additional Excise Commissioner- Systems

- Contact Number: 2236-0625, 2221-6205

- Email ID: dcit.wb-excise@nic.in

FAQ’s

The Excise Directorate aims to meet the two goals I.e

Preventing the manufacture, supply, and distribution of illicit/counterfeit/spurious liquor and/or non-duty paid intoxicants

Maximising the state’s revenue potential by ensuring that all liquor available in the state is sourced and sold through legal channels. Thus reducing public health risks. Duty on various types of intoxicants and fees are the major sources of revenue.

A- The M&TP (ED) Act 1955 and Rules framed thereunder contain similar provisions. The provisions of the B. E. Act 1909, as well as the Rules enacted under it, are regarded to be repealed.

Answer: The B. E. Act’s regulatory powers are provided under section 86. The provision of G.O.No.812-Ex dt. 12-05-1936 (page 187 of Comp. Part II) is abolished (especially 20A of the Rules.). Under Rule 20 and 20A, no license in form 19A can be enforced.

A- If an officer authorized under the M&TP (E.D.) Act, 1955 and Rules 1956 has reason to assume that dutiable goods have been stored without payment of duty, the officer may review challans/Bills, etc. to determine whether the proper duty has been paid.