Bank Locker Charges for SBI vs ICICI Bank vs PNB vs Axis Bank | Latest Fee and Charges for Bank Locker | Bank Locker Charges Per Month for SBI, ICICI, Canara Bank

A common way to store valuables is in bank lockers, often known as safe deposit lockers. For this service, banks impose a fee that is based on the size of the locker. Customers can rent bank lockers from many banks and certain of their branches in exchange for a deposit; lockers are assigned based on availability. The prices for bank lockers and the different sizes that are offered at State Bank of India (SBI), ICICI Bank, Punjab National Bank (PNB), and Axis Bank are shown below. (All fees and locker sizes are listed on the individual bank websites.)

Table of Contents

Bank Locker Charges

You can put all of your safety worries about your belongings to rest by using the bank’s locker. One of the most crucial services a bank offers is bank lockers. In India, bank lockers are often referred to as safe deposit lockers. These lockers are available in various sizes, such as small, medium, and large. But it depends on where the branch is located. The fees vary depending on the locker’s size and which bank branch you choose.

According to the bank’s website, bank locker fees range from Rs 500 to Rs 3,000 depending on the locality and locker size. In metro and metropolitan areas, the bank charges Rs 2,000, Rs 4,000, Rs 8,000, and Rs 12,000 for small, medium, large, and extra large size lockers, respectively.

In semi-urban and rural locations, the bank charges Rs 1,500, Rs 3,000, Rs 6,000, and Rs 9,000 for small, medium, big, and extra large size lockers, respectively. Let’s examine the fees for lockers at SBI, PNB, BON, and Canara banks.

ICICI Bank Locker Charges

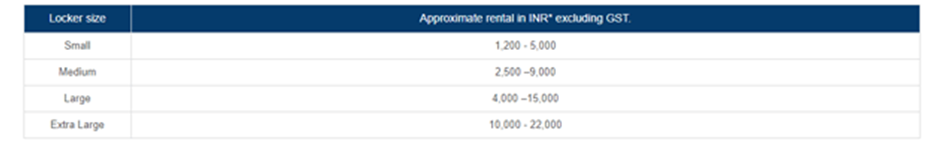

A locker can only accommodate a maximum of five hirers, according to ICICI Bank. To apply for a Safe Deposit Locker, you must have two photos, a notarized locker agreement, and a locker application.

Rent is paid annually in advance to ICICI Bank. The locker hirer must have an operational ICICI Bank account that is not due for Re-KYC and is not frozen, dormant, or inactive in order to assure fast payment of the locker rent. ICICI Bank costs between Rs 1,200 and Rs 5,000 for a small-size locker, and between Rs 10,000 and Rs 22,000 for an extra-large locker. Keep in mind that these fees do not include GST.

SBI Bank Locker Charges

Let’s take a look at locker charges in SBI

| Sizes – Locker Charges in SBI – Annual Rent |

| Small Size Urban and Metro : Rs. 2000+GST Rural and Semi-Urban: Rs. 1500+GST |

| Medium Size Urban and Metro : Rs. 4000+GST Rural and Semi-Urban: Rs. 3000+GST |

| Large Size Urban and Metro : Rs. 8000+GST Rural and Semi-Urban: Rs. 6000+GST |

| Extra-large Size Urban and Metro : Rs. 12000+GST Rural and Semi-Urban: Rs. 9000+GST |

| ——————————— |

| One-time locker registration Rs. 500 + GST Large and extra-large lockers: Rs. 1000+GST |

| Locker visit charges 12 visits free. Thereafter: ₹100 /- + GST per visit |

| Locker rent overdue charge (All sizes) 1 Qtr – 10% * 2 Qtr – 20% * 3 Qtr – 30% * 1 Year – 40% * *of the Annual rent to be recovered in addition to Locker Rent. |

| Safe Custody charges Rs 150/-+ GST per scrip. Min. Rs. 300/-+ GST p.a. or part thereof. |

Axis Bank Locker Charges

Customers of Axis Bank should be aware that upon surrender, they will NOT receive a refund of the annual rent collected. Every month there will be a 2.5 percent late payment fee, up to a maximum of 25 percent. There is a cap on the number of free visits at three per month, beyond which each visit would cost Rs 100 plus GST.

The Axis Bank website states that the rental fee for a small-sized locker at a metro or urban branch starts at Rs 2,700, a medium-sized locker at Rs 6,000, a large locker at Rs 10,800, and an x-large locker rental at Rs 12, 960. (GST will be additional; rental prices may differ amongst branches at the same location.)

Are Bank Safes Secure?

The new RBI regulations state that banks will be liable for any substantial material loss brought on by negligence.

According to the RBI announcement, banks must take all necessary precautions to ensure the safety and security of the locations where safe deposit vaults are kept. It must take care to prevent incidents like fire, theft, burglary, robbery, dacoity, and building collapse from happening on the bank’s property as a result of flaws, negligence, or any other act of omission or conduct. As banks cannot claim that they have no responsibility to their customers for the loss of the contents of the locker, their liability shall be limited to an amount equal to 100 times the annual rent of the safe deposit box in cases where the loss of the contents of the locker is caused by one of the aforementioned incidents or by fraud committed by one or more of their employees.

Activate SBI Debit Card Online

A New Locker Contract

Banks will start applying operating criteria on January 1, 2022, but in order for safe deposit locker owners to be qualified for the new compensation, they must sign a new locker agreement with the bank. By January 1, 2023, “Banks shall renew their locker arrangements with existing locker customers,” according to an RBI notification.

Locker Terms and Conditions for 2022–2023

- Rent is paid a year in advance.

- Rent is determined by the branch’s location and locker size.

- One-time registration charges.

- Customers who rent lockers must adhere to KYC (Know Your Customer) standards.

- Secure Storage Minors cannot be given a locker, either alone or collectively with others.

- Even if the rent is paid on time, the bank has the ability to cancel the locker allocation if the locker is left unattended for more than a year.

- The customer will NOT receive a return of any annual or monthly rent paid upon surrender.

- Any key loss should be reported right once to the bank branch. Any loss is not the responsibility of the bank. The renter is responsible for paying the fees associated with opening the locker, replacing a lost key, and changing the lock.

- New- In the event of a fire, theft, building collapse, or employee fraud, banks will only be liable for 100 times their yearly rent.

- New – In accordance with the RBI’s guidelines, banks are permitted to receive a TD (i.e., term deposit) at the time of allocation that would pay for three years’ worth of rent as well as the costs associated with opening the locker in the event of such an occurrence.

- New: NTo be eligible for the new pay, owners of safe deposit boxes must sign a new locker contract with the bank.

- New: Banks must inform customers about the date and time of locker activity as well as the available dispute procedures before the day is out by sending an email and SMS alert to the client’s listed email address and mobile number as a positive affirmation.

- Always maintain the receipts and proof of your valuables, even gold.

- In order to receive compensation, keep a record of your priceless possessions and gold.

Document Required for Locker

- KYC documents

- Passport size Photograph

- Current or Savings account

- Security Deposit

- In case of Locker Custody with survivorship clause the bank will demand only the following papers:

1. Copy of Death certificate (duly certified from original).

2. Duly filled in the claim application in the prescribed form.

3. Stamped receipt for discharged safe custody receipt/Locker.

How Does SBI Get Lockers?

For instructions on how to obtain a locker at SBI, see below.

Locker Facility

SBI Locker facilities are available at a few branches, and locker allocation is based on space.

Eligibility

An individual can hire lockers (Singly or jointly).

He or she must have a Savings or Current account and be a customer of the branch.

Locker Availability

For the purpose of allocating lockers, SBI branches will keep a waitlist and provide transparency in the process.

After logging in under e-services, the open position is updated and shown.

OR

To check the opening without logging in, click here.

Allotment of the Locker

First-come, first-served locker distribution will take place, and a separate registration will be kept.

Each locker reservation request will be acknowledged and assigned a waiting number.

At the time of allotment, the hirer(s) will be required to open a specific type of Term Deposit to cover three years’ worth of rent and fees.

Agreement

The Locker Hirer(s) will get a copy of the duly executed Locker Agreement and allotment letter along with an acknowledgment from the Hirer.