UAN Registration | UAN Check Status | Universal Account Number Activation Portal | UAN Online Registration Process

As the entire process relating to the Employee Provident Fund (EPF) services is now performed online, the Universal Account Number i.e., UAN is crucial. With the help of UAN, you can easily access your PF account services such as withdrawals, monitoring EPF balance without the need of your employer, and applying for a PF loan. This post goes overall you need to know about your UAN Registration and Activation Portal.

Table of Contents

UAN (Universal Account Number) Registration

Every employee who contributes to the EPF is granted a 12-digit universal account number or UAN. The Employee Provident Fund Organisation (EPFO) generates and distributes it, while the Ministry of Labour and Employment of the Government of India authenticates it. An employee’s UAN remains the same throughout his or her career, regardless of how many positions he or she holds. EPFO assigns a new member identification number or EPF Account (ID) to each employee who changes jobs. This number is linked to the UAN. As an employee, you can submit a request for a new member ID to your new employer by submitting your UAN. After the member ID is formed, it is linked to the employee’s UAN. As a result, the UAN will serve as a single point of contact for the employee’s various Member Ids assigned by various employers.

Throughout an employee’s career, the UAN remains the same and is transferrable. When moving employment, the person must use a different member ID. To make EPF transfers and withdrawals easier, all of these member IDs are connected to the employee’s UAN.

Steps to Generate UAN & Check Status

1. Through Employer

According to the EPFO, your company will usually assign you a Universal Account Number. Some companies also print the UAN number on the pay stubs.

2. Using the UAN Portal and the PF number/member ID

You can also get your Universal Account Number from the UAN site if you can’t get it from your company. You must take the following steps:

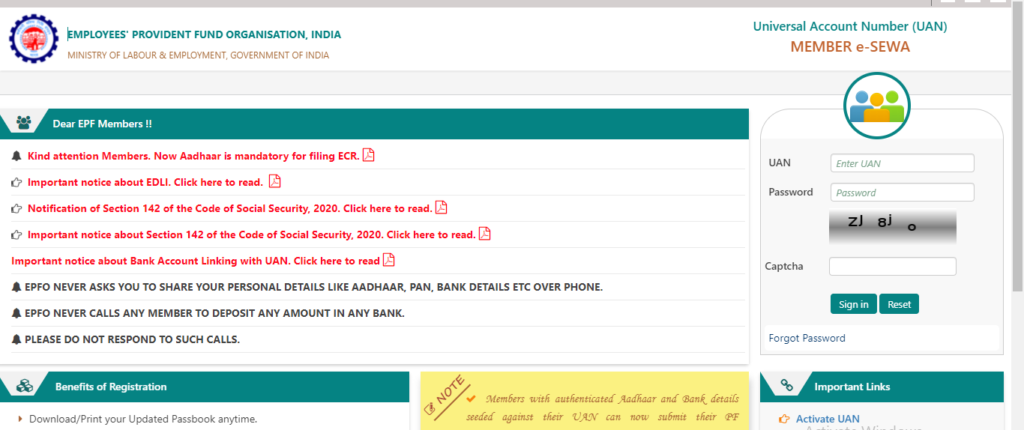

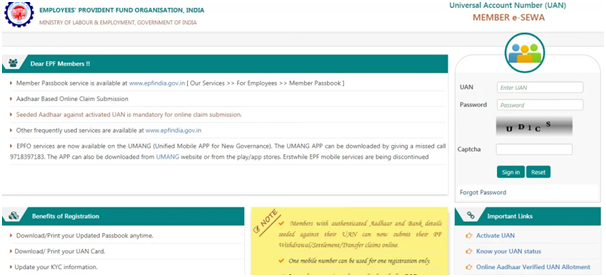

Step 1: Go to https://unifiedportal-mem.epfindia.gov.in/memberinterface/ on the UAN Portal.

Step 2: Select the ‘Know your UAN Status’ tab. The next page will be displayed.

Step 3: From the dropdown menu, choose your state and EPFO office, then input your PF number/member ID, as well as additional information such as your name, date of birth, phone number, and captcha code. Your PF number/member ID can be found on your pay stub. Go to the ‘Get Authorization Pin’ tab.

Step 4: A PIN will be sent to your phone number. Click the ‘Validate OTP and obtain UAN’ button after entering the PIN.

Step 5: You will receive a text message with your Universal Account Number.

UAN Registration and Activation Portal

You’ll need your Universal Account Number and PF member ID to activate UAN.

The steps to UAN Registration on the EPFO portal are as follows:

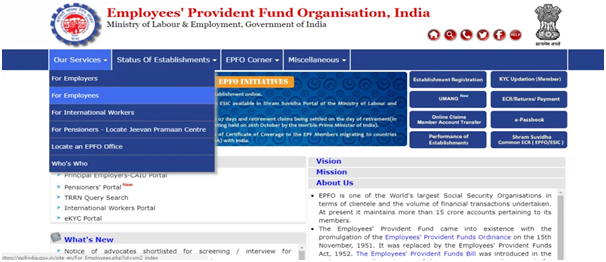

Step 1: Go to the EPFO homepage and click on ‘For Employees’ on the dashboard under ‘Our Services.’

Step 2: In the services area, select ‘Member UAN/Online services.’ You will be directed to the UAN portal.

3rd Step:

- Enter your PF member ID, mobile number, and Universal Account Number. Captcha characters must be entered. To obtain an authorization PIN, click the ‘Get authorization PIN’ button. The PIN will be sent to your registered mobile phone number.

- Under the disclaimer option, click on ‘I Agree,’ then input the OTP you received on your phone number and click on ‘Validate OTP and Activate UAN.’

- You will receive a password to access your account after activating your UAN on your registered mobile number. Your UAN Registration will be done.

UAN Registration features and advantages

- The UAN aids in the centralization of employee data across the country.

- One of the most important uses of this unique number is that it relieves the EPF organization of the burden of employee verification from enterprises and employers.

- With the implementation of UAN, the number of untimely and early EPF withdrawals has decreased significantly.

- EPFO was able to extract the member’s bank account details and KYC without the involvement of the employer’s thanks to this account.

- EPFO can use it to keep track of an employee’s repeated employment changes.

Employee Benefits from UAN

- Each new PF account associated with a new job will be consolidated into a single unified account.

- With this number, it is easy to withdraw (totally or partially) PF online.

- Employees can use this unique account number to transfer their PF amount from one account to another.

- You can get a PF statement at any time (for visa purposes, loan security, and so on) by checking in with your member ID or UAN or by sending an SMS.

- If your UAN is already Aadhaar and KYC-verified, future employers will not need to confirm your profile.

- UAN ensures that employers cannot access or withhold the PF money of their employees.

- It is easier for employees to ensure that his/her employer is regularly depositing their contribution in the PF account.

What are the documents needed to open a UAN account?

- You’ll need the following documents to receive your Unique Account Number if you’ve recently started working for your first registered firm.

- Any photo-affixed and national identity cards such as a driver’s license, passport, voter ID, Aadhaar, and SSLC Book are acceptable forms of identification.

- Account number, IFSC code, and branch name are all required.

- Your PAN card should be connected to your UAN.

- A recent utility bill in your name, a rental/lease agreement, a ration card, or any of the ID proofs listed above with your present address on it.

- The Aadhaar card is a unique identification number issued by the government of India. It is required because Aadhaar is connected to a bank account and a cell phone number.

- ESIC card (European Social Insurance Card)

FAQ’s

When an employee joins the Employee Provident Fund Organisation (EPFO), the EPFO assigns UAN.

Yes, you cannot file online claims without a UAN.

Yes, the UAN and the PAN are related.

No, because the amount in EPF accounts is connected to the UAN, which is transferable across all qualifying employers, this is not possible.

No, each employee is only allowed to have one UAN, which is transferrable to all qualifying businesses.