Mudra Loan Scheme Apply Online | How To Apply for Mudra Loan Scheme | PM Mudra Loan Scheme Interest Rate | Mudra Loan Scheme Bank Loan

In India, there are many micro, small, medium, and large companies. Every year, this number increases by leaps and bounds. These companies have the potential to make a significant contribution to the economy of the country. Many of these, however, have ceased operations due to a lack of money. The Pradhan Mantri MUDRA Yojana was introduced by the central government to assist these businesses with funding (PMMY). Companies can get business loans in the form of mudra loans ranging from Rs.50000 to Rs.10 lakh under this plan. Let’s look at the Mudra Loan Scheme and how to apply for a MUDRA loan online in this post.

Table of Contents

About Pradhan Mantri MUDRA Yojana (PMMY)

On April 8, 2015, the Prime Minister introduced the Pradhan Mantri MUDRA Yojana (PMMY). Non-corporate, non-farm small/micro-enterprises can apply for loans of up to ten lakh under the scheme. These loans are referred to as MUDRA loans under the PMMY program.

What Is A MUDRA Loan, and How Does It Work?

Individuals and MSMEs can apply for loans up to Rs.10 lakh under the PMMY plan to establish or expand their businesses. These loans are referred to as MUDRA loans, and they are available without the need for any type of collateral or security. Micro-Units Development and Refinance Agency Ltd. is the acronym for MUDRA

Commercial banks, RRBs, Small Finance Banks, MFIs, NBFCs, and other qualifying financial intermediaries as authorized by MUDRA Ltd provide MUDRA loans. The MUDRA loan scheme offers adjustable EMIs and payback terms ranging from 12 months to 5 years. You might contact any of the above-mentioned institutions. Alternatively, you can apply for a MUDRA loan online through the Udaymimitra portal i.ehttps://udyamimitra.in/

MUDRA Loan Yojana’s Features

Individuals, MSMEs, firms, or businesses in the manufacturing, trading, or service sectors in rural and urban areas can apply for this loan.

| Interest for MUDRA Loan | It differs from one bank to another bank and depends on business needs |

| Minimum Loan Amount granted | No limit for the minimum loan amount |

| Maximum Loan Amount granted | Up to Rs.10 lakh |

| Types of Loan | Shishu, Kishor, and Tarun |

| Loan Amount under Shishu | Up to Rs.50000 |

| Loan Amount under Tarun | Rs.500001 to Rs.10 lakh |

| Loan Amount under Kishor | Rs.50001 to Rs.5 lakh |

| Collateral/Security | Not required |

| Processing Charges | Nil |

| Repayment Tenure | 12 months to 5 years |

| Age limit | Minimum age 18 years and Maximum age 65 years limit |

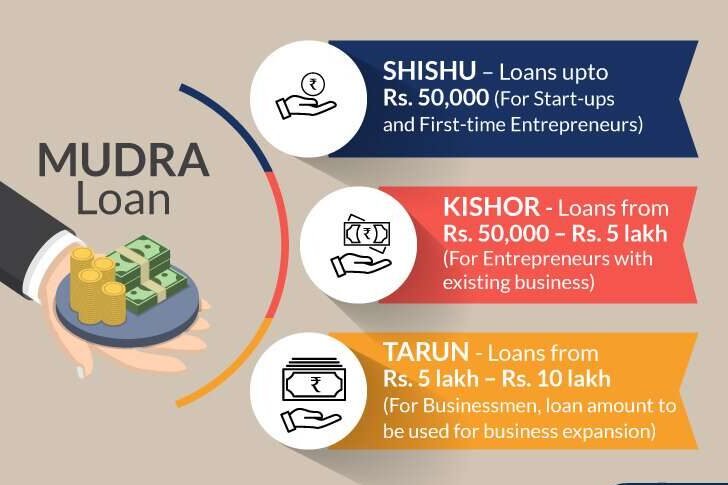

MUDRA Loan Types

MUDRA loans are available under the auspices of PMMY in three categories:

1. Shishu Loan Scheme: Loans up to Rs.50000 for new businesses and start-ups.

2. Kishor Loan Scheme: Loans ranging from Rs.50001 to Rs.5 lakh are available for the purchase of equipment, machinery, raw materials, and the growth of existing businesses.

3. Tarun Loan Scheme: Established businesses and enterprises can apply for loans ranging from Rs.500001 to Rs.10 lakh.

To boost the confidence of young people who want to be first-generation entrepreneurs. Shishu category units receive more attention, followed by Kishore and Tarun categories.

According to the Shishu, Kishore, and Tarun categories, you can get a business loan ranging from Rs.50000 to Rs.10 lakh through the MUDRA loan scheme.

MUDRA Loans’ Purpose

MUDRA loans can be used for a variety of objectives, all of which result in revenue and job creation. The following are the key reasons why these loans are given out.

- A loan for traders, shopkeepers, vendors, and other service-related organizations.

- Working capital loans via MUDRA cards.

- Small-business equipment financing (Micro units).

- Transportation vehicle loans (for commercial use only).

- Agri-allied non-farm income-generating businesses such as beekeeping, pisciculture, poultry farming, and so on are eligible for Mudra loans.

- Loans for tractors, tillers, and two-wheelers used solely for commercial purposes.

Activities Included Under MUDRA Loans

The following is a list of examples of activities that can be covered by this loan:

- Vehicles that are used to convey products and passengers

- Community, socially, and personal service concerned activities.

- The food products industry.

- The textile products industry and its activities.

- Traders and shopkeepers can get business loans.

- Equipment financing program for small businesses.

- Agriculture-related activities

MUDRA Loan Interest Rate

The interest rate for MUDRA loans varies from bank to bank. The interest rate on a MUDRA loan is determined by the applicant’s profile and company needs.

This loan is available from a number of partnering banks, NBFCs, and MFIs. Participating banks who want to get a refinance from MUDRA will have to peg their interest rates according to MUDRA Ltd.’s recommendations from time to time.

The interest rate on a MUDRA loan will be determined by the lender’s policy. The MUDRA loan rate of interest charged to the borrowers, on the other hand, must be appropriate. The interest rate on a MUDRA loan is determined after examining the applicant’s biography and company requirements.

Eligibility Requirement for MUDRA Loan

Any Indian individual in rural or urban India who has a business strategy for manufacturing, trading, or service sector activities. Any participating bank, non-banking financial institution (NBFI), or microfinance organization can provide MUDRA loans (MFIs).

To be eligible for a MUDRA loan, you must meet the following criteria:

- A person who is between the ages of 18 and 65.

- An MSME

- A shopkeeper

- Trader

- Small manufacturer

- Owner of a business

- A start up entrepreneur

- Small-scale business owner

- Artisan

- An individual linked to agricultural activities.

Note that the applicant must not be a bank or financial institution’s defaulter. He or she must also have a good credit history to qualify for the loan.

Documents for MUDRA Loans

The following is a list of MUDRA loan documents:

- Application Form: Completed application form for the loan category you are applying for.

- Identity proof: Passport, Aadhaar card, voter’s ID card, PAN card, driving license, etc.

- Address Proof: Passport, voter identification card, Aadhaar card, utility bills (electricity, telephone, and water bills), and so forth.

- Photographs: Two passport-size photographs are required.

- Caste Certificate: Proof of special category, such as SC, ST, OBC, Minority, etc., if applicable.

- Provide proof of your company’s address.

- Other Documents: A quotation for the things that will be purchased and used in the business.

Note: Kishor and Tarun share a common loan application form. In addition, there is a separate application form for Shishu.

Mudra Loans’ Advantages

- Individuals, traders, shopkeepers, vendors, artisans, and MSMEs in the trading, manufacturing, and service sectors are eligible for loans.

- These loans can be used to borrow small sums of money at a low interest rate.

- The Government of India assumes the credit guarantee of the borrower under the Mudra plan.

- The loan amount can be used for term loans, working capital loans, and overdrafts.

- This loan is available to small or micro-enterprises that are involved in income-generating activities.

- The loan is available at a reduced interest rate for female customers.

- People from the SC and ST categories can get this loan at a lower interest rate.

- Borrowers are given a MUDRA card. This card can be used to withdraw loan funds as needed by the firm.

- The loan repayment period can last up to seven years.

- There is no requirement for collateral or security in order to participate in this plan.

How do I Apply for a MUDRA loan?

The MUDRA loan application process is as follows:

- Make sure you have all of the essential documentation on hand. To apply for this loan, you must have the necessary documentation. These documents include proof of identification, proof of address, and proof of business.

- The next step is to find a lender who is part of the MUDRA program. Simply complete the loan application form.

- Submit the completed loan application form with all required papers.

This loan is available through the Pradhan Mantri Mudra Yojana (PMMY), which can be obtained from a bank, an NBFC, or a microfinance institution (MFI). On the Udyamimitra portal, you can now apply for a MUDRA loan online at https://udyamimitra.in/

MUDRA has not appointed any agents or middlemen to help people obtain loans. As a result, you should avoid anybody who claims to be intermediaries or agents for the MUDRA or PMMY schemes.

List of MUDRA Loan Banks

MUDRA loans are available from the following lending institutions:

- Public Sector Banks

- Private Sector Banks

- Regional Rural Banks (RRBs)

- Small Finance Banks (SFBs)

- Cooperative Banks

- Non-banking Financial Companies (NBFCs)

- Micro Finance Institutions (MFIs)

What Kind of loan is Mudra Loan?

MUDRA is a non-bank financial institution that supports the growth of the micro-enterprise sector in both rural and urban areas. It helps participating banks, MFIs, and NBFCs refinance loans to micro-businesses of up to ten lakh rupees. Under the PMMYyojana initiative, it gives loans to micro-businesses.

Subsidy for MUDRA Loans

The loan given under the Pradhan Mantri MUDRA Yojana is not subsidized (PMMY). However, if your loan proposal is tied to a government program that qualifies for a capital subsidy, it will also qualify under PMMY.

FAQ’s

There are 3 types of Mudra Loan.

If a Mudra loan is not paid back, the loan is classified as a non-performing asset. In addition, if you do not repay the loan, the lender has the right to take legal action against you. The lender may potentially confiscate the borrower’s assets and sell them to repay the loan.

No one will go to jail for defaulting on a loan: A person cannot be charged with a crime for defaulting on a loan.