LIC Saral Pension Yojana 2022 Apply Online | LIC New Saral Scheme Interest Rate | LIC Saral Pension Yojana Application Status | LIC New Saral Scheme Online Registration

LIC Saral Pension Yojana was launched by the Life Insurance Corporation of India (LIC) on July 1, 2021. The insurance companies have been advised by the IRDAI to launch the Saral Pension Yojana 2022. The Saral Pension Scheme is a standard immediate annuity plan under the Insurance Regulatory and Development Authority of India (IRDAI) guidelines, with the same terms and conditions offered by all life insurers. The policyholder can select between two types of annuities based on the payment of a lump-sum amount.

The scheme is applicable to all insurance companies in India. The LIC Saral Pension Yojana is also referred to as an intermediate annuity scheme. Furthermore, it has immediate scheme effects. Because each bank has its own insurance policy. In addition, it offers pension plans to its account holders.

Table of Contents

LIC Saral Pension Yojana Scheme 2022

On 1st July 2021, the LIC (Life Insurance Corporation of India) has now launched the LIC New Saral Pension Scheme. It also has a single premium, non-participating, non-linked individual annuity plan. In these projects, each insurance company has a unique name and set of benefits. Companies have demonstrated that their plans/projects have a competitive advantage, to entice more customers to visit them.

The Insurance Regulatory and Development Authority of India has the authority to issue guidelines. They provided timely advice to insurance companies for the benefit of the public. Because each company has described its policy plans more thoroughly than the others. As a result, the general public has a difficult time locating a beneficial scheme for them.

LIC Saral Pension Yojana Overview

| Name of the Scheme | LIC Saral Pension Scheme |

| Launched by | Insurance Regulatory and Development Authority Of India (IRDAI) |

| Main Purpose of the scheme | To Provide simple terms and conditions under a pension policy |

| Type of Scheme | Pension Yojana |

| Application Mode | Both Online/ Offline |

| Official Website | licindia.in |

| Apply online | LIC Saral Pension Apply Online 2021 |

Choosing the best insurance plan is a task in itself. According to IRDAI, the guidelines for Saral Pension Yojana are simple, equal, and clear. The LIC Saral Pension Scheme provides its holders with two annuity options.

Post Office Monthly Income Scheme

LIC Saral Pension Interest Rates

Though in our country there are numerous insurance companies and various plans were presented. However, LIC Saral Pension Yojana provides a variety of benefits to its policyholders. Saral Pension Plan (Mode of Annuity) is the second division of the LIC Saral Pension Scheme. It has four operating modes. In LIC Saral Pension Yojana, the first is the annuity mode. The second option is the Loan facility. Applicants can pay a huge sum amount as the plan’s acquisition price. Then he or she can receive a fixed amount of money as a pension for the rest of his or her life.

It is available on a yearly, half-yearly, quarterly, and monthly basis. An incentive has been made available for the purchase price of more than 5 Lakh in order to increase the annuity rate. Saral Pension Plan Loan Facility.

It has also provided a loan facility to its policyholders. After six months of policy initiation. This facility is also available to policyholders. Insurance companies are regulated by the IRDAI. As a result, insurance companies provided the Saral Pension Yojana.

They also offer standard immediate annuity products. With their assistance, the public can easily select the best policy for them.

By establishing these scheme standards. Trust has also grown between insurance customers and companies. It also put a stop to the misselling of insurance policies throughout the country.

Saral Pension Scheme Features

Under LIC Saral Pension Scheme, there are no maturity benefits. IRDAI issued a circular to all life insurance companies in January 2021. As there are many insurance companies in our country working to provide people with policies and plans. However, due to IRDAI regulations, all insurance companies are required to implement the Saral Pension Scheme Standard Policy by the end of April.

Following are the features of the LIC Saral Pension Scheme

- Saral Pension Scheme offers a single premium instant annuity plan that is not linked.

- It has four payment options: monthly, quarterly, semi-annually, and annually.

- It also includes a non-participating strategy.

- Saral Pension Scheme primarily offers two annuity options.

- In this scheme, the policyholder will also be able to obtain a loan.

- With the payment of a lifetime annuity, a full refund of the purchase price is available.

- The policyholder will receive an annuity as a result of their investment.

The rate of interest for the insurance plan may differ from one company to the next. However, the name must be the same as Saral Pension Scheme, and the benefits must be similar. An Annuity is a return of investment for the customer by insurance companies. Saral Pension offers a standard intermediate annuity product for individuals. As a result, you only need to pay one premium. Then your pension will be activated.

A pension is a type of financial assistance provided to an employee after he or she retires. In India, having a pension after leaving a job allows people to be self-sufficient. If they receive a pension, they are relieved of stress in their later years. The facility of granting an annuity to policyholders on their investment has been made available under this scheme.

LIC Saral Pension Annuity Amount

The minimum amount determined over the course of the period is:

- 12000 Rs for Yearly

- 6000 Rsfor Half yearly

- 3000 Rsfor Quarterly

- 1000 Rs Saral Pension PolicyMonthly

If the employer or a family member discovers a critical illness in the policy document. The assistant may then surrender the policy at any time after 6 months from the policy’s issue date. The authority has also revised the list of critical illnesses in response to the customer’s requests. On the surrender of the policy, 95 percent of the price of the policy purchase has been given. When the surrender amount is paid, the policy will be terminated.

Eligibility Criteria for LIC Saral Pension Yojana

Applicants who want to opt for LIC Saral Pension Yojana must fulfill some criteria set by the concerned authorities. Following are the eligibility criteria that applicants must fulfill before opting for this yojana.

- The candidate must have a permanent address in India i.e applicant should possess Indian citizenship.

- The applicant’s age should be between 40 and 80 years old and not exceeding 80 years.

- Furthermore, there is no upper limit for the maximum amount.

- The minimum purchase amount for policy should be 1000 Rupees.

- Jeevan Neem Company sells this policy to candidates.

- The maximum purchase amount is determined by the customer.

Documents Required for LIC Saral Pension Yojana Scheme

Before applying for LIC Saral Pension Yojana Scheme, applicants must keep the following documents in hand.

- Permanent Residence Proof

- Age Proof

- Aadhar Card Identity Proof (Voter Card/ PAN Card etc)

- Passport Size Photo

- Income Proof

- Bank Details

- Contact Details

LIC Saral Pension Yojana Application Form

The step by step procedure to apply for LIC Saral Pension Scheme is as follows:

- First of all visit the official website of LIC i.e https://licindia.in/.

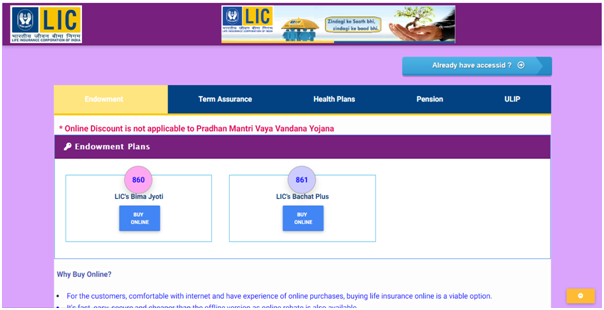

- The home page of the website will appear in front of you as shown below

- On the home page, go to the ‘BUY POLICY ONLINE’ tab and click on the ‘LIC’s Saral Jeevan Bima’ option. A new page with two options will open as seen below:

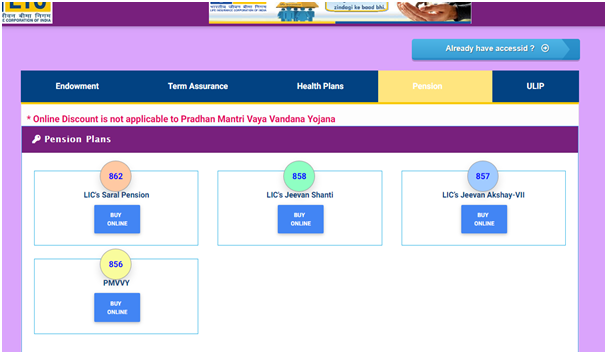

- Now click on ‘Pension’ option in the menu bar.

- Now click on the first option with number 862 number i.e LIC’s Saral Pension.

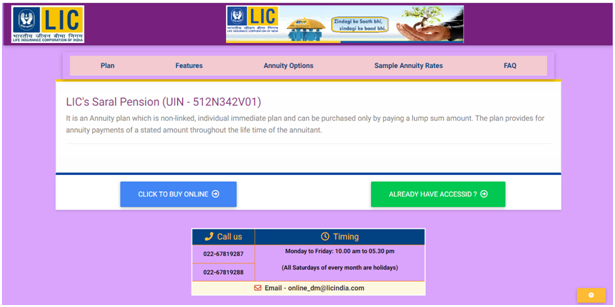

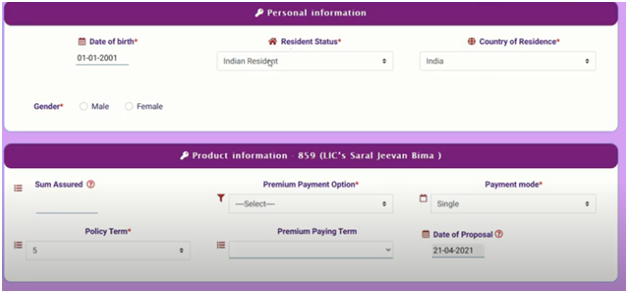

- After clicking on this option you will see the below page

- Now as you can see two option are available on the screen. One is CLICK TO BUY ONLINE and another is ALREADY HAVE ACCESSID. If you are going to buy it for the first time then click on the first option i.e CLICK TO BUY ONLINE. However, if you have already purchased it then you can track your form by clicking on the second option i.e ALREADY HAVE ACCESSID.

- Now after clicking on first option, a new page will open as shown below: Here you need to fill a form by filling the required information i.e your name, Date of Birth, Mobile number, email id. Also you need to select your city, captcha and click on I agree option.

- Click on Calculate Premium option at the bottom.

- Now an OTP will be sent to your mobile number. Here you need to type that OTP.

- It will also show your access ID here.

- Now again fill the details on the screen and click on Calculate Premium option.

- After that your premium details will open on your screen. Click on confirm and proceed.

- Now a small window of Copy Data from Previous policy will appear on the screen. Click on yes or no option.

- Now you have to enter some details.

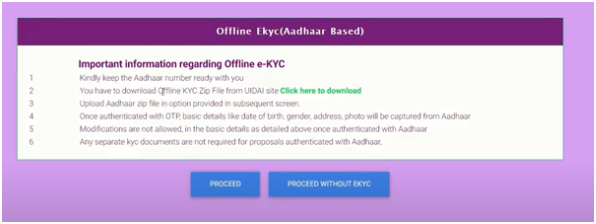

- If you click on proceed without Kkyc, then you need to fill details on the next page and click on save and proceed option.

- Finally proceed to payment.

- Then an email will be sent to you from the LIC Company asking you to send the required documents.

Contact

If you have any queries related to LIC Saral Pension Scheme, feel free to contact me on the below mentioned phone number. You can also mail at the email ID mentioned below.

| Call us | Timing |

| 022-67819287 | Monday to Friday: 10.00 am to 05.30 pm |

| 022-67819288 | (Every month all Saturdays are holidays) |

| Email – online_dm@licindia.com |

FAQ’s

Buying life insurance online is a viable option for customers who are comfortable with the internet and have previous experience with online purchases.

It’s faster, easier, more secure, and less expensive than the offline version because an online rebate is also available.

According to a LIC press release, the Saral Pension schemes offer two annuity options:

Ist option is Life Annuity with a 100% return on the purchase price

Second option is Joint life last survivor annuity with a 100% return on the purchase price on the death of the last survivor.

The regular annuity is paid until the covered person dies in a single life plan. When a husband and wife purchase this plan together, if one of them dies, the surviving spouse continues to receive regular annuity income until death.

Both options include a full refund of the purchase price, which means that if the annuitant dies, the money used to purchase the policy is returned to the nominees. It is returned after the death of the covered person in the case of single life, and after the death of the last surviving spouse in the case of joint life.

This plan is available both off line as well as online. As a result, you can purchase this policy both through your LIC agent and online at wwww.licindia.in.