LIC Jeevan Tarun Policy Apply Online | LIC Jeevan Tarun Policy | Interest Rate Calculator | LIC Jeevan Tarun Policy Premium Chart PDF

The Life Insurance Corporation provides a lot of different types of schemes for people who want to have a really easy retirement and you can take into consideration the details related to the specifications of the LIC Jeevan Tarun policy given below and we will also share with you all the details related to the interest rate provided by the organization in this scheme. Make sure to also check out the benefits and the features available by the authorities in the LIC Jeevan Tarun Policy before investing your money in this prestigious scheme. We have also shared with all of you the options available in this scheme and the maturity and death benefits.

Table of Contents

LIC Jeevan Tarun Policy 2022

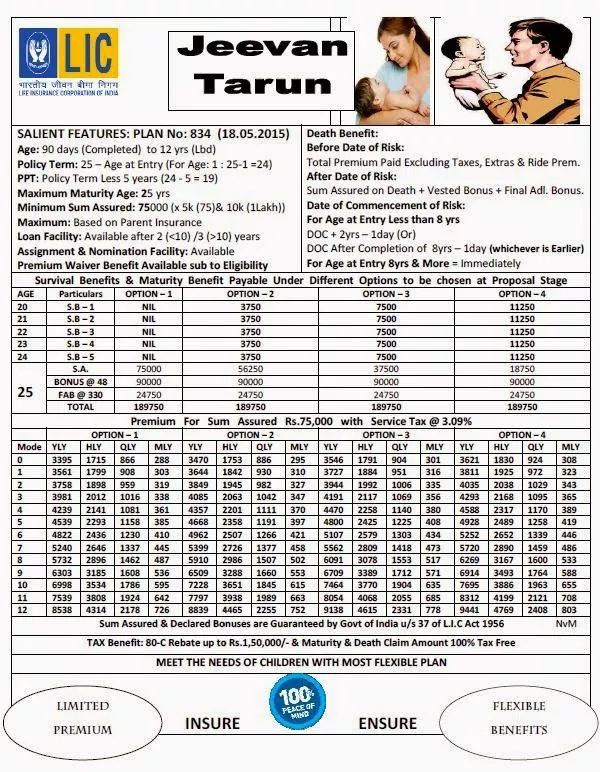

LIC Jeevan Tarun Policy is a participating non-linked limited premium plan which will offer you life insurance services also and you will also be provided savings for your children. You can take into concentration this plan and it will definitely meet your educational and several other needs for your growing children with the annual survival benefit payment. The payment is available from the age of 20 to 24 and the maturity benefit will be provided to the children at the age of 25 years. As compared to other plans it is a very flexible plan prepared by the LIC organization and there are four options available in this plan so that you can take into consideration the benefits as per your needs.

Options Available

The following benefit options are available to the beneficiaries under the LIC Jeevan Tarun Policy 2022:-

| Options | Survival Benefit | Maturity Benefit |

| Option 1 | No Survival Benefit | 100% of Sum Assured + vested Bonuses |

| Option 2 | 5% of Sum Assured paid every year for the last 5 policy years | The remaining 75% of the Sum Assured is paid + vested Bonuses |

| Option 3 | 10% of Sum Assured paid every year for the last 5 policy years | The remaining 50% of the Sum Assured is paid + vested Bonuses |

| Option 4 | 15% of Sum Assured paid every year for the last 5 policy years | The remaining 25% of the Sum Assured is paid + vested Bonuses |

Benefits Of The Scheme

There are many benefits of the LIC Jeevan Tarun Policy and you can check out the benefits given below:-

- The policyholder gets a Final Additional Bonus and Simple Reversionary Bonuses.

- Survival Benefit- If the policyholder survives till the maturity age, then a certain % of the Sum Assured is given to the policyholder as Survival Benefit in the last 5 years, and the policy remains active as per the schedule chosen at the policy inception.

- Maturity Benefit- If the policyholder survives the complete tenure of the policy, then the amount leftover of the Basic SA plus the bonuses acquired are paid to the policyholder as per Maturity Benefit, and thus the policy gets terminated.

- Death Benefit- In case of the policyholder’s sudden demise during the policy’s tenure, the Sum Assured at the time of Death along with the acquired Bonuses are paid to the person nominated by the policyholder. This does not depend on the amount paid as a survival benefit. Sum Assured is the higher of

- 125% of the Sum Assured was chosen while taking the policy.

- 10 times the annualized premium as being paid.

- Subject to a minimum of 105% of the total premiums paid as of the date of death.

Rider Available With Jeevan Tarun Policy

The riders available in the LIC Jeevan Tarun Policy 2022 from the details given below:-

- Under the LIC’s Premium Waiver Benefit Rider, future payments of the premiums are waived off in case of unforeseen demise of the subscriber (the one who makes payments of the premiums).

- The policyholder gets to leverage the mode of payment for yearly and half-yearly premium payments.

- Income tax benefit on the premium paid to the policyholder under Income Tax Act since the basic Sum Assured is 10 times the Annualized Premium.

Specifications Of The Scheme

Check out the specifications of the LIC Jeevan the one policy from the table given below:-

| Details | Minimum | Maximum | |

| Entry Age (Last Birthday) of Child | 90 days | 12 years | |

| Maturity Age (Last Birthday) of Child | – | 25 years | |

| Maturity Age (Last Birthday) of Proposer | – | No Limit unless Premium Waiver Benefit rider has opted for | |

| Policy Term (PT) in years | 25 – Age at the entry of the child | ||

| Premium Paying Term (PPT) in years | 8 | 20 | |

| Premium Paying Frequency | Annual, half-yearly, quarterly, and monthly | ||

| Sum Assured | Rs 75000 | No-Limit | |

Eligibility Conditions and Other Restrictions

The candidates must follow the following eligibility criteria in order to apply for the LIC Jeevan Tarun policy:-

| Minimum Sum Assured | Rs. 75,000 |

| Maximum Sum Assured | No Limit |

| (The Sum Assured shall be in multiples of 5,000 from Sum Assured 75,000 to 100,000 and 10,000/- for Sum Assured above 100,000) | |

| Minimum Age at entry | [90] days (last birthday) |

| Maximum Age at entry | [12] years (last birthday) |

| Minimum/ Maximum Maturity Age | [25] years (last birthday) |

| Policy Term | [25 – Age at entry] years |

| Premium Paying Term (PPT) | [20 – Age at entry] years |

Documents Required

The following documents must be submitted to apply for the LIC Jeevan Tarun policy:-

- Medical history

- Address proof

- Know your customer documents

- Medical examination (depending on your age or the sum assured)

Rebates Details

You can check out the details related to the rebate available in the LIC Jeevan Tarun policy 2022 from the table mentioned below:-

| Mode Rebate | |

| Yearly mode | 2% of Tabular Premium |

| Half-yearly mode | 1% of Tabular premium |

| Quarterly, Monthly mode | NIL |

| High Sum Assured Rebate (on Premium) | |

| Sum Assured (SA) | Rebate (Rs.) |

| 75,000 to 1,90,000 | Nil |

| 2,00,000 to 4,90,000 | 2 per thousand SA |

| 5,00,000 and above | 3 per thousand SA |

FAQs For LIC Jeevan Tarun Policy 2022

The LIC Jeevan policy will provide you benefit in tax and all of the premiums are tax exempted.

Yes, you can take a loan against the Jeevan Tarun policy in need but your policy should be more than 3 months old and over the free look period.

If you surrender your policy within 1 year then you will get 70% of the single premium paid and after completing one year you will get 90% of the returns on the single premium paid.

The policyholders have the leverage of 30 days to pay the premium.

This plan gives the policyholder a period of 15 days to think about whether they wish to continue the plan or not. This gives you an option to cancel the policy within this period if the policyholder has made no claim.