KMC Property Tax Online Payment | KMC Property Tax Search Property | KMC Property Tax Print e-Receipts

Property Tax is a yearly tax levied by the relevant government bodies on a real estate property. These monies are collected by the respective municipalities to offer civic facilities and other services. Similarly, Kolkata residents must pay annual taxes to the KMC (Kolkata Municipal Corporation). Read below to check the detailed information related to KMC Property Tax 2022-23 like Online Calculation of KMC Property Tax, Base Unit Area Calculation, Property Tax Computation Formula, Pay KMC Property Tax Online, and much more.

Table of Contents

KMC Property Tax 2022-23 – Comprehensive Details

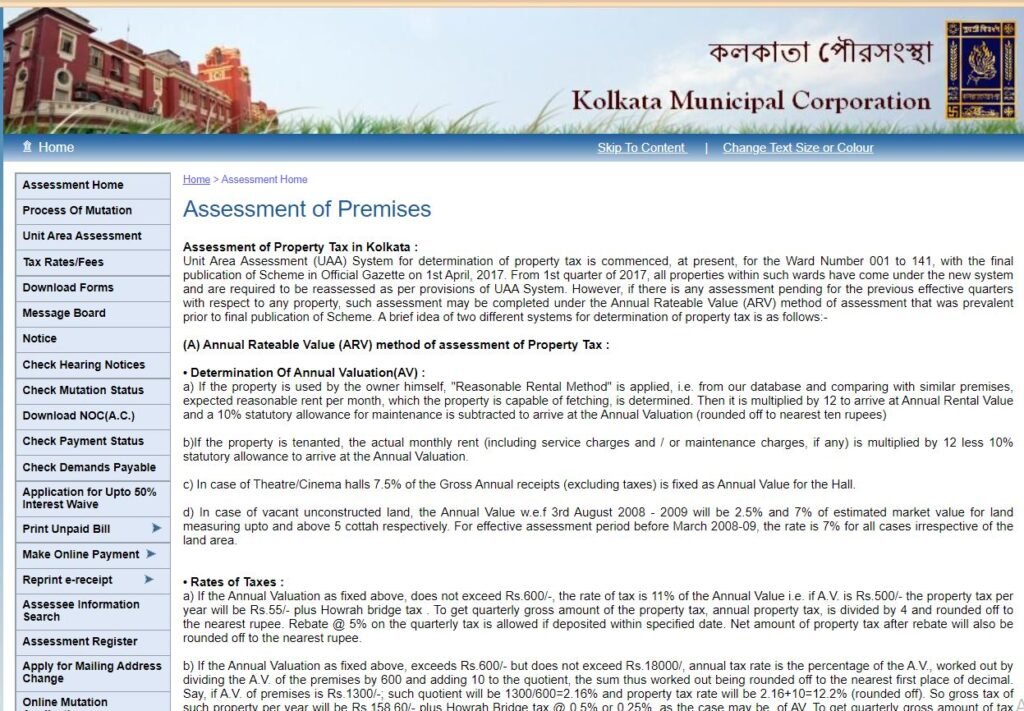

The Kolkata Municipal Corporation Bill was passed on December 15, 2016, to streamline the tax collection procedure. The Kolkata Municipal Corporation is in charge of collecting property taxes in Kolkata (KMC). Kolkata Municipal Corporation (KMC) was given the authority to evaluate an individual’s property tax and to oversee rate increases and decreases.

Online Calculation of KMC Property Tax

To calculate property taxes, the Unit Area Assessment (UAA) system was passed in March 2017. The property tax can be estimated by the owners under the system. The adoption of UAA meant that the prior system’s ambiguity and subjectivity were eliminated.

Base Unit Area Calculation

| Category | BUAV per square feet (Rs.) |

| A | 74 |

| B | 56 |

| C | 42 |

| D | 32 |

| E | 24 |

| F | 18 |

| G | 13 |

Important Points to Consider When Assessing a Unit Area

Some of the Important Points to Consider When Assessing a Unit Area are as follows:

- The infrastructure, facilities, and market value of the property are used to divide it.

- Kolkata has 293 blocks and categories, ranging from A to G, according to the UAA system.

- Every category will be given a BUAV (Base Unit Are Value). The BUAV for category A will be the highest, while the BUAV for category G will be the lowest.

- The new system covers approximately 6 lakh taxpayers.

Property Tax Computation Formula

The following is the formula used to determine the property tax under the UAA system:

Annual Tax = BUAV x Space that is covered/ Area of the land x Rate of tax (inclusive of HB tax) x Occupancy MF value x Structure MF value x Age MF value x Usage MF value x Location MF value

Steps to Pay KMC Property Tax Online

Taxpayers can pay their property taxes online through the KMC’s official website. User needs to follow the below-given steps to Pay KMC Property Tax Online:

- First of all, go to the official website of KMC Portal

- The homepage of the website will open on the screen.

- Under the Online Services option, click on the Assessment-Collection option

- A new page will open on the screen

- Now, click on the Make Online Payment option

- Once you will click on the Make Online Payment option, sub-options will display on the screen i.e.,

- Current PD: This option is the periodic demand for bills.

- Outstanding LOI: LOI or Letter of Arrears is for bills that have not been paid.

- Fresh Supplementary: These are bills that have been issued after a change has been made on the previous bill that was issued.

- After selecting the appropriate option, you must input the email address, phone number, and assessee number.

- Now, click on the Pay button

- On the following page, the amount that must be paid will be presented. You can pay your bill and get a copy of your e-receipt at the same time. You can also choose to reprint the receipt.

Steps to Find the Assessee Number

User needs to follow the below-given steps to find the Assessee Number

- First of all, go to the official website of KMC Portal

- The homepage of the website will open on the screen.

- Under the Online Services option, click on the Assessment-Collection option

- A new page will open on the screen

- Click on the Assessment Information Search option

- A new page will open on the screen

- Now, enter all the required details

- Ward No

- Street

- Premise No

- Assessee No

- Finally, click on the Search button to find the Assessee Number

How Do You Acquire a Tax Receipt?

Tax receipts or challans are required to be collected regardless of how you pay your Kolkata corporation property tax. You can download the challan from the official website and reprint it if you neglect to do it the first time. After paying the fees in offline mode, you can pick up a receipt at the respective centers.

Contact Us

For further details or in case of any query or complaint related to the KMC Property Tax 2022-23, feel free to contact on the below-given contact number. On weekdays, the phone line is open from 10 a.m. to 6 p.m., and on Saturdays, it is open from 10 a.m. to 5 p.m.

Contact Number: 33-2286 1305

FAQ’s

The full form of the KMC is Kolkata Municipal Corporation

The KMC government’s official website address is www.kmcgov.in

Yes, Kolkata Municipal Corporation residents can pay their property taxes online.

Unit area assessment (UAA) is a method for standardizing the property tax system based on the size, location, uses of the property, age of the property, type of occupancy, and structure.