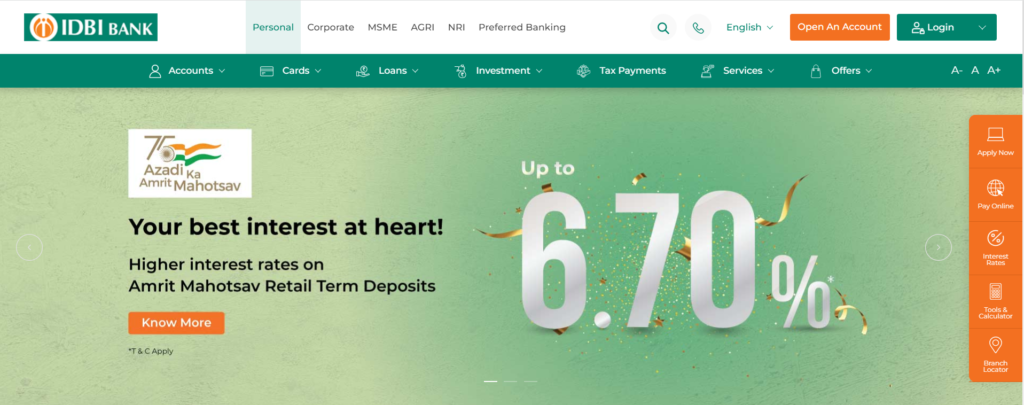

IDBI Bank FD has launched a fixed deposit scheme under the name of Amrit Mahotsav Fixed Deposit scheme. Under this scheme, IDBI Bank is offering an interest rate of 6.70% p.a. for the tenure of 500 days. In this article, we are providing the details of the IDBI Amrit Mahotsav FD scheme.

Table of Contents

IDBI Bank Fixed Deposit Scheme

IDBI Bank is operating various fixed deposit schemes. Bank pays attractive interest rates based on the tenure of fixed deposits. Higher interest rates are offered on senior citizen fixed deposit accounts. IDBI Bank Amrit Mahotsav FD scheme is a limited-time, special fixed deposit program offered by IDBI Bank that matures in 500 days. On August 22, 2022, the bank canceled its 1100-day Amrit Mahotsav FD Scheme, but IDBI Bank FD replaces it with a new fixed deposit scheme of 500-day tenure with a 6.70% rate of interest p.a.

IDBI Bank Amrit Mahotsav FD Scheme

IDBI Amrit Mahotsav FD scheme is divided into 2 categories, Callable Fixed Deposit and Non-Callable Fixed Deposit. Both FDs come with a tenure of 500 days.

IDBI Bank Amrit Mahotsav Callable Fixed Deposit

- Under the callable FD general customers, the non-residential external and non-resident ordinary will get an interest rate of 6.10% per annum.

- Resident Senior citizens will get the interest rate of 6.60% per annum

- The tenure for the callable fixed deposit is of 500 days

IDBI Bank Amrit Mahotsav Non-Callable Fixed Deposit

- Under the non-callable fixed deposit general customers, the non-residential external, and non-resident ordinary will get an interest rate of 6.20% per annum.

- Resident Senior citizens will get the interest rate of 6.70% per annum

- Premature withdrawal and premature closure is not allowed under the non-callable fixed deposit

- Tenure for the non-callable fixed deposit is of 500 days

Benefits of IDBI Bank Fixed Deposit

Fixed deposits of IDBI Bank come with many perks. Here we are sharing various benefits of IDBI Bank FD

- Assured Returns on Your Investment

The best part of IDBI Bank FD is that it provides assured returns on your investment. IDBI Bank offers attractive interest rates on your fixed deposit investment.

- Safest Bank for Fixed Deposit

IDBI Bank is one of the safest banks in India for fixed deposit accounts. IDBI Bank is rated and certified by ICRA and CRISIL, the well-known Indian rating agencies.

- Funds Backed by Government

Funds in IDBI Bank are backed by the Indian government, making it a safe and reliable bank. Due to backing from the Indian Government, your funds are safe irrespective of the situation of the bank.

- Easy and Hassle-Free Loans

IDBI Bank offers easy and hassle-free loans against fixed deposit accounts. The interest rate of loans against FD is 2%-3% lesser than regular loan interest rates. Processing fees of loans against fixed deposits are almost zero.

How To Apply For IDBI Bank FD Amrit Mahotsav

If you are interested in IDBI Bank FD, then you need to apply for your FD account. The application process for IDBI Bank FD is very simple and easy.

- Application through Official Website– You can apply for your fixed deposit account through the official website of IDBI Bank. All you need to do is to visit IDBI Bank’s official website and click on apply now tab.

- Application Through Phone Banking- IDBI offers applications through phone banking. You need to call toll free number of IDBI Bank and follow the instruction. The toll-free number of IDBI is 1800-209-4324 & 1800-22-1070

- Visiting IDBI Bank Branch– Users can apply for their fixed deposit account by visiting the nearest branch of IDBI Bank

Conclusion

A fixed deposit account in IDBI Bank is safe and reliable because the bank is backed by the Indian government. You can save money by opening a fixed deposit account, as it offers attractive interest rates.