Gstr-3b Is For Sale Or Purchase | GSTR-3B Return Filing Format | GSTR-3B Last Date | GSTR-3B New Rules

If you are filing your GST document then you must also be familiar with the additional certificate that you need to file along with two certificates presented by the Income Tax Department. There are a lot of documents that you need to submit in order to file your GST with the Income Tax Department of India and given below, we are sharing the specifications related to the GSTR-3B certificate. We will also share with all of you the specifications of the Return Filing Format, Last Date, & New Rules.

Table of Contents

GSTR-3B

When you are submitting the GST R1 and GSTR-2 return forms then it is important for all of the business owners to also file the GSTR-3B monthly self-declaration because it will have the summary of all of the GST liabilities for a particular tax period. It is important to file the GSTR-3B form even if you are having no business activity. The businessman cannot revise this declaration and you will have to file the certificate separately. It will have to be filed on a monthly basis and there are also some exceptions to this form. You will have to submit this form on the 20th of every month for the succeeding month. If you want to submit your form for September then you will have to submit it on 20th October.

Last Date For GSTR-3B

You had to file the GST form each and every month and the due date for submission for this form is the 20th date of the succeeding month but from January 2020 onwards: The due dates have been staggered. Taxpayers opting for the QRMP scheme from 1st January 2021: The due date is 22nd or 24th of the month following every quarter, as per the State/UT of the principal place of business.

Eligibility Criteria

The applicant must follow the following eligibility criteria before successfully applying for the form:-

- Every person who is registered under GST must file GSTR-3B.

- However, the following registrants do not have to file GSTR-3B

- Taxpayers registered under the Composition Scheme

- Input service distributors

- Non-resident suppliers of OIDAR service

- Non-resident taxable persons

Late Fees And Penalty

There is also a particular late fee and penalty that you will have to give for this particular form and given below we are sharing the details:-

- Taxpayers with NIL GST liability: Rs. 20/day of delay

- Other taxpayers: Rs. 50/day of delay

- Moreover, penal interest at the rate of 18% per annum will be charged on the outstanding tax amount.

Details To Be Filled

There are various details that you will have to fill in the GSTR-3B form presented by the authorities and given below we are sharing the details of all of them:-

- Table 1: Details of outward supplies and inward supplies liable to reverse charge

- Outward Taxable Supplies other than Zero Rate, Nil Rate and Exempted

- The Outward Taxable Supplies (Zero Rated)

- Outward Supplies towards Nil Rated and Exempted

- Inward Supplies liable to be paid on a reverse charge basis

- Non-GST Outward Supplies

- Table 2: Details of Interstate supplies made to unregistered persons, composition dealers and UIN holders

- Interstate supplies made to Unregistered Persons

- The Interstate supplies made to Composition Dealers

- Interstate supplies made to UIN Holders

- Table 3: Details of eligible Input Tax Credit

- ITC Available: On inward supplies on which the ITC was availed, such as Import of Goods or Services, supplies liable to fetch reverse charge, supplies from ISD, and other inward supplies, as applicable.

- ITC Reversed: On the usage of inputs/input services/capital goods used for a non-business purpose, or partly used for exempt supplies. Also, if the depreciation is claimed on the tax component of capital goods, plant and machinery – then the ITC will not be allowed. Such reversals need to be captured in this table.

- Eligible ITC: Calculated by deducting ITC Reversed from ITC Available.

- Ineligible ITC: Details of GST paid on inward supplies listed in the negative list, which are not eligible to fetch input tax credit.

- Table 4: Details of exempt, nil-rated and non-GST inward supplies

- Supplies from composition dealers, exempt and nil-rated inward supplies

- Non-GST inward supplies

- Table 5: Payment of Tax

- Tax paid through ITC (CGST, SGST / UTGST, IGST & Cess)

- Tax paid TDS / TCS

- Tax / Cess paid in Cash

- Interest & Late Fees

- Table 6: TDS / TCS Credit

- In this table, one needs to capture the details of TDS and TCS, for CGST, SGST / UTGST & IGST. However, as a business, these will not be that crucial at the moment, as these provisions are deferred from the initial rollout of GST, and are not applicable, till notified further.

Format of GSTR-3B

Given below, we are sharing the details related to the format of the GSTR-3B certificate:-

- Section 1: Questionnaire pertaining to business activities and tax liabilities for the current tax period.

- Section 2: A box showing GST-return related information, including Return Status.

- Section 3.1: Box for filling out details of tax on outward and inward supplies liable to reverse charge

- Section 5.1: Exempt, nil and non-GST inward supplies

- Section 5.2: Interest and late fee

- Section 6.1: Payment of Tax

How To File For GSTR-3B Online?

There is a very easy procedure through which you will be able to file for the form online and given below we are sharing the step by step procedure:-

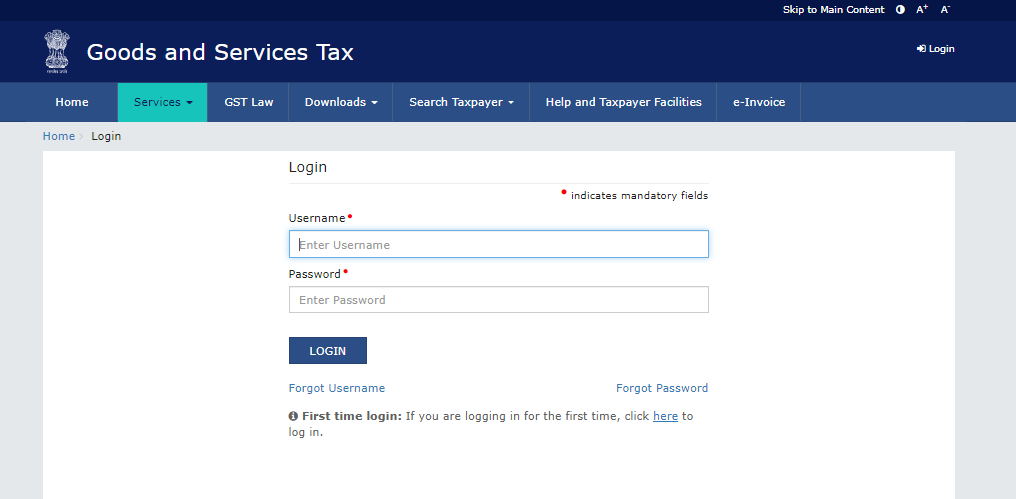

- You will first have to login into the GST portal with your credentials.

- The dashboard will be displayed on your screen.

- You have to click on the option called “Returns Dashboard”.

- Select the Financial Year and the return filing period.

- Click on the search button and the tiles of all returns to be filed will be displayed.

- Click on the “Prepare Online” button on the GSTR3B tile.

- A message showing how GSTR 3B filing has become more user-friendly will be displayed. Read the message and click OK.

- A list of questions pertaining to business activities and tax liabilities for the current tax period will be displayed. Answer the questions relevant to you.

- Click Next and GSTR3B monthly return page will be displayed showing return related information and return status.

- Scroll down to see the following options:

- Back: To re-initiate the filing process from the Return dashboard and redo your responses in the questionnaire.

- Save GSTR-3B: Click this each time you make entries to save the entered details.

- Reset GSTR 3B: To delete the entered details and start afresh.

- Click on the first tile (Section 3.1 link) to start GSTR-3B filing. Enter details of various outward and inward supplies and click “Confirm”.

- You will be redirected to the Returns page. Click the second tile and enter details in the relevant sections. Ensure that the total amount of integrated tax declared in Section 3.2 is less than or equal to that declared in Section 3.1.

- Enter details in all the other pages of the form and ensure that you save the draft GSTR-3B form periodically.

- Click on the “Preview draft GSTR-3B”.

- If there is no error in the draft GSTR3B, click “Proceed to Payment”.

- Scroll down and you will see “Cash Ledger” balance with return related liabilities. The ledger will be auto-populated with taxes to be paid in part or full by ITC (Input Tax Credit).

- If you do not have sufficient balance in the Electronic Cash Ledger, you will be prompted to create a challan. Select “Yes” to create a new challan.

- On the “Create Challan” page, select the relevant payment mode and click on generate challan button to make payment.

- Preview draft GSTR3B and ensure that the last column pertaining to “Additional Cash Required” is zero.

- Click “Make payment/ post the credit to ledger”.

- Click “Yes”. Offset Successful message will be displayed.

- Select “Proceed to File”

- Select the declaration check box and click “File GSTR 3B with EVC/DSC”. EVC stands for Electronic Verification Code while DSC stands for Digital Signature Certificate.

- Click “Proceed”.

- A successful filing message will be displayed bearing “Acknowledgement Reference Number (ARN)”. Note this number for future reference.

- Now, click “Download filed GSTR-3B” to view the file GSTR3B.

How To File For GSTR-3B Offline?

There is a very easy procedure through which you will be able to file for the form offline and given below we are sharing the step by step procedure:-

- You will first have to login into the GST portal with your credentials.

- The dashboard will be displayed on your screen.

- Click on the “Downloads” tab on the GST portal.

- Now, click on the Offline Tools and then click on GSTR3B Offline Utility.

- Extract the excel utility from the zipped folder and open the excel file.

- Click on the “Enable Editing” button in the excel sheet.

- Enter the legal name of the registered person, GSTIN, FY and month.

- Enter details in Section 3.1 – Tax on outward and reverse charge inward supplies.

- Enter details in Section 3.2 – Inter-state supplies. Ensure that the total amount of integrated tax declared in tile 3.2 is less than or equal to that declared in tile 3.1.

- Enter details in Section 4 – Eligible ITC.

- Enter details on Section 5.1- Exempt, nil and non-GST inward supplies.

- Enter details in Section 5.2 – Interest and late fees.

- Validate the entered details using the Validate button.

- Generate JSON file using the Generate file button.

- Upload the JSON file on the GST portal by selecting the “Prepare Offline” option on the returns dashboard.

How To Check GSTR-3B Application Status?

There is a very easy procedure to wish you will be even to check the application status of this certificate and given below we are sharing the details:-

- You will first have to login into the GST portal with your credentials.

- The dashboard will be displayed on your screen.

- You have to log in using your credentials and click on “Returns Dashboard”.

- Select the Financial Year and the return filing period.

- Click on “Search”.

- All the relevant GST returns will be displayed along with their filing status.

FAQ

It is a monthly return form. The due date for every month is the 20th of the succeeding month. For example, the due date to file GSTR 3B for September 2019 is 20th October 2019.

All of the people are eligible to file the GSTR-3B form along with the other GST forms apart from NRI.

You will have to enter all of the financial details related to income tax and GST in order to file this certificate.

Yes, filing GSTR3B filing is mandatory for all the normal and casual taxpayers, including those with no business in the particular tax period.