Table of Contents

Introduction

Employees’ Provident Fund Organisation is a non-constitutional organization of the Indian Government, which works for the upliftment of the Indian service class or salaried people. The main objective of the EPFO is to provide social security to the working class and salaried people of India. Today here in this post we will provide you with every minute detail of EPFO. We will provide you with information about the universal account number UAN card how to withdraw PF from the EPFO website etc. Please read the post carefully for detailed information on EPFO, EPF, and UAN.

What is Employees’ Provident Fund Organisation EPFO?

EPFO is the non-constitutional government body that works under the Ministry of Labour and Employment of India. The objective of the Employee Provident Fund Organisation is to regulate and manage provident funds of Indian salaried people by doing this EPFO is providing social and financial security to the working class Indians. The EPFO is administered by the Central Board of trustees known as CBT.

Central Board of Trustees Consist

- 1 Chairman

- 1 Vice-chairman

- 5 Central Government representatives

- 15 State government representatives

- 10 Employees’ representatives

- 10 Employer’ representatives

There are various developments in EPFO since its Incorporation. On 1st October 2014, EPFO got linked with a universal account number popularly known as UAN. With the help of UAN accessing an EPF account becomes very convenient and easy

Objectives and Key Achievement of EPFO

The objective of the Employee Provident Fund Organisation is to provide world-class social security services to the member of EPF. EPFO is working consistently towards this goal with improved standards of compliance. Here we are sharing key achievements of EPFO.

- EPFO has successfully reduced the time for settlement of claim from 1 month to 3 days.

- It provides hassle-free services to its member by ensuring that all EPF-covered establishments are complying with EPFO requirements and standards.

- EPFO updates the account of EPF members on monthly basis.

- It also provides hassle-free one-line access to the member account.

- In addition to making improvements to its facilities, EPFO ensures that its online services are reliable.

- A voluntary compliance program is also promoted and encouraged by Employee Provident Fund Organisation

EPFO Flagship Schemes

Employees’ Provident Fund Organisation successfully operates 3 social service schemes-

- Employees’ Provident Funds Scheme 1952 (EPF)

- Employees’ Pension Scheme 1995 (EPS)

- Employees’ Deposit Linked Insurance Scheme 1976 (EDLI)

Services Offered by EPFO

Employees’ Provident Fund Organisation offers various services for the employee and employer like PF withdrawal, online establishment registration, Umang app, etc. Here we are providing detailed information on services offered by EPFO

- PF Withdrawal- With the help of UAN, EPF member can easily withdraw their PF amount online in case of emergency or unemployment for more than 2 months. However, it is mandatory to link Aadhar Card and Bank account details with universal account number UAN, for successful withdrawal of the amount.

- Certificate of Coverage (COC) For International Workers– Indian workers who are working in countries who are having social agreements with India are able to generate coverage certificates using EPFO software.

- Claim Status, Passbook, and Online PF Payment– The EPF members can keep track of the status of their claim, they are also able to view and download their PF account passbook by using UAN. EPFO made it mandatory for the entire organization to make payments of provident funds online. Currently, 10 banks are collaborating with EPFO for collecting dues

- UMANG App– Unified Mobile Application for New-age Governance (UMANG) is launched by the EPFO for fast and convenient access of EPF accounts. The EPF members can avail benefits of the UMANG Mobile App simply by logging into it using their UAN and Password. They can view account passbook, claim status, and update their profile details by using the UMANG app.

- Miss Call, SMS Service, and Register Grievance– Registered members of EPF with activated UAN can check the details of their provident account by simply giving a miss call on 011-22901406 or by sending an SMS to 7738299899. EPF member can also register their EPF-related grievance on EPFO. Rectification of grievance is one of the most important priorities of EPFO.

- Online Helpdesk for Inoperative Accounts- Online helpdesk for inoperative accounts is incorporated by EPFO, registered members can easily check old and inoperative accounts by using UAN. It is possible for employees to track these accounts and withdraw funds, or transfer them to their current member IDs.

What is Employee Provident Fund EPF

Employee Provident Fund EPF is commonly known as Provident fund (PF). PF is a post-retirement benefit scheme for the contributing members of EPF. It is the primary scheme of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952; it is managed and regulated by the Employees’ Provident Fund Organisation India. Under this scheme, a certain percentage of the employee’s salary is contributed to the scheme, while the employer contributes an equal amount. When the employee retires, they receive a total amount including their own contribution as well as the employer’s contribution, with interest.

Benefits of Employee Provident Fund

- It helps save money over a longer duration of time

- A small amount will be contributed to your EPF account on a monthly basis, from your salary and your employer’s contribution, so you don’t need to pay a hefty amount at once.

- As the deductions are made from the salary of an employee on a monthly basis, the employee is able to save a great deal of money over a long period of time.

- When an employee retires, this saved money helps to maintain a comfortable lifestyle.

- Under the section 80C of the income tax, this retirement benefits scheme is exempted from income tax

- In case of emergencies like medical treatment, loan repayment, and marriages, EPF members can partially withdraw the amount from their EPF account.

- Under the Employees Deposit Linked Insurance Scheme (EDLI) EPF account holders can avail benefits of free insurance of up to Rs 7 lakhs in case of death during the service period.

- Under the Employees’ Pension Scheme (EPS), 1995, an EPF member can avail lifelong pension of a minimum of Rs 1000.

Eligibility Criteria of EPF

Here we are sharing eligibility criteria for EPF

- Salaried employees with salaries below Rs.15,000 per month, must register for an EPF account.

- Members from all over India can avail of benefits of the EPF scheme except the state of Jammu and Kashmir

- As per the law, companies, and organizations having more than 20 employees are required to participate in the EPF scheme.

- Companies with fewer than 20 employees may participate in the EPF scheme willingly.

- A person who is earning more than Rs.15,000 can register for an EPF account; with the approval of the Assistant PF commissioner

What is Universal Account Number UAN

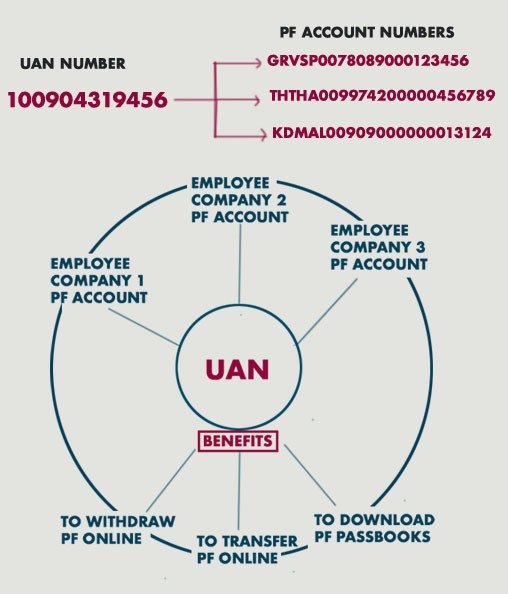

A 12-digit unique number assigned to every contributing member of EPFO is known as a universal account number or UAN. UAN number of the employee will remain same throughout his/her life irrespective of employee multiple job changes. When an employee changes his/her job, a new UAN linked member identification number or EPF Account (ID) is provided by the EPFO to the employee. Employees need to activate their UAN whenever they change their job, to avail online services.

Key Role and Benefits of UAN Number

Universal account number UAN is introduced to simplify the transaction of provident funds. It is introduced by PM Narendra Modi on 1st October 2014 with the vision to facilitate EPF members by providing them a seamless experience during the transaction of provident fund amounts.

- By using UAN, you can manage all your PF accounts in one place regardless of how many employers you might have had during your career.

- Through UAN you will be able to access your PF account in a more organized and efficient manner, saving you the effort of maintaining multiple passwords and account details for different PF accounts.

- Employees and employers can maintain records of PF account balances online through the UAN without any hassle

- A UAN number allows the employer to quickly and easily process and validate a withdrawal request for an employee’s provident fund

UAN Number Generation and Important Documents Required

In the service sector, if a company has more than 20 employees, the employer must obtain the employee’s UAN for him the first time he joins. Here we are sharing the complete list of important documents required for UAN Generation

- Aadhar Card

- Bank Account Details

- PAN Card

Conclusion

Employees’ Provident Fund Organisation works for the upliftment of service class Indian people. The Objective of EPFO is to provide financial security to its members post-retirement. With the help of UAN, members of EPF can take benefit of various services offered by EPF organization