ECLGS Scheme Apply Online | ECLGS Scheme Full Form | Emergency Credit Line Guarantee Scheme Interest Rate

The Indian Finance Ministry and the Financial Services Department presented the ECLGS Scheme on February 29, 2020. This programme aids MSMEs in meeting their daily operating costs and other financial obligations. This initiative was reported to be a component of the big economic packages worth Rs. 20,00,000 crores.

In a nutshell, the Emergency Credit Line Guarantee Scheme is a godsend for small businesses that are trying to make ends meet. The programme assists micro and small enterprises in meeting their daily expenses while also assisting them in achieving a specific cash flow and healthy revenue.

You’ll learn more about the scheme’s eligibility conditions, the application process, features, credit limit, interest rate, scheme validity, and much more in this post.

Table of Contents

About ECLGS Scheme

The Emergency Credit Line Guarantee Scheme, or ECLGS Scheme, as its name suggests, is one of the best-guaranteed credit plans in an emergency, with the government providing 100 percent coverage. MSMEs are encouraged to pursue their aspirations and desires under the scheme.

MSMEs who seek loans up to Rs. 3,00,000 crores under the “Guaranteed Emergency Credit Line” between May 23, 2020, and October 31, 2020, are usually welcomed by the Emergency Credit Line Guarantee Scheme.

The credit product of this arrangement is referred to as the Guaranteed Emergency Credit Line. However, because of the Covid-19 epidemic, the ECLGS scheme has been extended through September 30, 2021, to assist MSMEs.

Emergency Credit Line Guarantee Schemes Versions

- Emergency Credit Line Guarantee Scheme 1.0

- Emergency Credit Line Guarantee Scheme 2.0

- Emergency Credit Line Guarantee Scheme 3.0

- Emergency Credit Line Guarantee Scheme 4.0

Emergency Credit Line Guarantee Scheme 1.0

As of February 29, 2020, this scheme provides full guarantee credit to firms with a credit limit of up to Rs. 50 crores. The scheme is offered to businesses that outperform all others in terms of credit loan applications.

Emergency Credit Line Guarantee Scheme 2.0

This scheme, unlike Emergency Credit Line Guarantee Scheme 1.0, is extended to 26 other sectors recognised by the Kamath Committee as of September 4, 2020. This programme is aimed for firms with outstanding financial obligations. Typically, the candidate must seek funding in the range of Rs. 50 crores to Rs. 500 crores.

Emergency Credit Line Guarantee Scheme 3.0

The Emergency Credit Line Guarantee Scheme 3.0 is the final extended version of the Emergency Credit Line Guarantee Scheme. Hospitality, tourism and travel, and sports are among the industries covered by this programme. This policy is extremely useful for enterprises seeking credit in excess of Rs. 500 crores.

In the Covid crisis, the fundamental goal of this programme is to provide comprehensive guarantee coverage for the credit line up to 20% of the available loan by February 20, 2020. The percentage varies depending on the industry. For example, the Hospitality, Travel & Tourism, and Sports industries each have a 100% guarantee coverage of up to 40%.

Emergency Credit Line Guarantee Scheme 4.0

The Government of India has announced a three-month extension of the Rs 3 lakh crore Emergency Credit Line Guarantee Scheme to September 30, 2021, from June 30, 2021, or until guarantees for an amount of Rs 3 lakh crore are issued under the fourth revision of the scheme, dubbed ECLGS 4.0, in order to help Covid-affected MSMEs even more.

For the most part, scheme loans are provided by reputable banks and financial institutions under extended schemes (ECLGS 1.0, ECLGS 2.0, ECLGS 3.0, ECLGS 4.0).

Features of ECLGS Scheme

The Emergency Credit Line Guarantee Scheme, or ECLGS, has a number of advantages that you should take advantage of.

- ECLGS is a term loan with a deadline of October 31, 2020 to apply. This means that only the businesses that applied for loans through the Guaranteed Emergency Credit Line will be able to use them.

- The maximum amount of credit accessible under the Emergency Credit Line Guarantee Scheme, according to the Indian government, is Rs. 3,00,000 crores.

- The fundamental goal of the initiative, according to the Indian government, is to assist micro and small companies in maintaining their financial viability in this epidemic period.

- The National Credit Guarantee Trust Company Ltd, or simply NCGTC, presented the ECLGS programme.

- The ECLGS scheme has a four-year or 48-month duration. The business only has to pay interest for the first year. However, the corporations will be required to pay both the interest and the principle sum in the following years.

- To use the Emergency Credit Line Guarantee Scheme, you must meet a few requirements. In the following sections, we’ll go through this in further detail.

- The ECLGS scheme is available to MSMEs, small businesses, trusts, registered businesses, and people who start their own businesses.

Eligibility for Emergency Credit Line Guarantee Scheme Program

The following are the eligibility requirements for the application process.

- The borrower must be a registered member of the GST (Goods and Services Tax) registrar. Before applying for the Emergency Credit Line Guarantee Scheme, these are the key requirements that must be met.

- Candidates with SMA 2 or NPA are not eligible for this programme. These are the two key elements to consider for scheme availability, even if there are no further eligibility requirements.

- Partnerships, registered corporations, trusts, and other recognised small businesses are eligible for the majority of the programme plans.

- Individually owned enterprises have fewer opportunities to obtain loans.

- The candidate’s accounts must be at least 60 days old by February 29, 2020.

These are some of the points to think about while applying for an Emergency Credit Line Guarantee Scheme. Only if the borrowers meet all of the requirements will the ECLGS loan be approved.

How to Apply for ECLGS Scheme

Any lending institution, including commercial banks, financial institutions, and non-banking financial organisations, can participate in the ECLGS scheme. The scheme is only open to pre-authorized users, not to new customers who are signing up right now. Visit the ECLGS website for further information.

You must first check the Guaranteed Emergency Credit Line’s qualifying requirements, which are listed here.

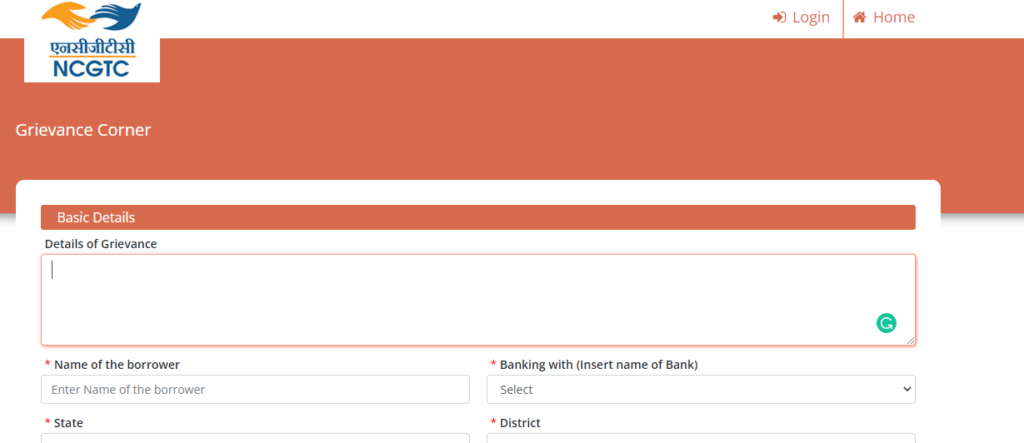

Submit Grievance

- Click here to go to the grievance submission page.

- Provide details of grievance your personal details, etc.

- Select submit option.