Bajaj Finserv Insta Emi Card Apply Online | Bajaj Finserv Insta Emi Card Application Form | Bajaj Finserv Insta Emi Card Interest Rates

The Bajaj Finserv EMI Network Card, formerly referred to as the Bajaj Finserv EMI Card, is a one-of-a-kind line of credit that emerges with a pre-approved limit of up to Rs. 4 lakh. The Bajaj Finserv Insta EMI Card is similar to an EMI Network Card in that it requires a 100 percent online application process and is activated immediately. Read below to check the detailed information related to Finserv Insta Emi Card like Objectives, Features, Benefits, Eligibility Criteria, Interest Rates, and much more.

Table of Contents

Bajaj Finserv Insta Emi Card – Comprehensive Details

To get your Finserv Insta EMI Card, all you have to do is pay a one-time registration fee, and then it’s all yours to use for your purchases without needing to pay any additional interest on your EMIs. For buying, you will receive your Digital Bajaj Finserv Insta EMI Card on your screen immediately. This credit line can be used for a variety of in-store and internet purchases, including everything from home appliances to grocery shopping. In addition, the card will be used at partner stores to get no-interest EMI on purchases.

Objectives of Bajaj Finserv Insta Emi Card

The Bajaj Finserv Insta EMI Card is a financing facility or a card that allows you to convert all of your buying into no-interest EMI payments.

Benefits of Finserv Insta Emi Card

Some of the key benefits of the Bajaj Finserv Insta Emi Card are as follows:

- The process is completed entirely online.

- Approval Time is 30 Seconds

- In 2 Minutes, you can get your Digital Bajaj Finserv Insta EMI Card

- Get approval of up to 2 lakhs

- Simply pay a one-time fee of rupees 567 to join

- There are no documents required

- Easy EMI’s are available for both offline and online shopping

- Almost a million items are available with no interest EMIs

- The tenor of up to 24 months

- Accessible in over 1900 plus cities across India

- Accepted in over a million stores

Features of Bajaj Finserv Insta Emi Card

Some of the key features of the Bajaj Finserv Insta Emi Card are as follows:

- Pre-approved Loan: The card comes with an Rs. 4 lakh pre-approved loan that can be used at any of Bajaj Finserv’s 60,000+ partner stores in over 1,300 cities.

- Flexible Repayment Period: You have the option of repaying the loan over a period ranging from three months to two years.

- E-commerce Friendly: You can use the card online at major e-commerce portals in addition to in-store buying.

- E-Wallet: You can use the Bajaj Finserv EMI Network card with the Bajaj Finserv Wallet app. As a result, you won’t have to hold your card around with you because you can use the mobile app to make in-store payments.

- Simple Documentation: It includes one-time documentation, which requires you to submit only the most basic documents to purchase any product on EMI. At the time of purchase, existing EMI Network Cardholders do not need to submit any documents.

Interest Rates on Bajaj Finserv EMI Network Cards

When you use the Bajaj Finserv EMI Network Card to buy and then choose products from partner stores, you can get “No Cost EMI,” which means you won’t have to pay any interest. For example, if you make a purchase of Rs. 1 lakh on No Cost EMI for a year, you will only have to pay a monthly installment of Rs. 8,333 for the entire year and there will be no interest amount. Mobile phones, laptops, refrigerators, television sets, washing machines, and air conditioners are among the products that can be purchased on “No Cost EMI” with the Bajaj Finserv EMI Network card.

Eligibility Criteria

Applicants who want to apply for the Bajaj Finserv Insta Emi Card must fulfill the eligibility criteria put forward by the Government of India. The eligibility criteria for Finserv Insta Emi Card are as follows:

- You must be at least 21 years old and no older than 60 years old.

- You must have a steady source of revenue.

Required Documents

While filling up the application form for Finserv Insta Emi Card, some important documents will be needed by the user, make sure to keep them handy. The documents required for Emi Card are as follows:

- Bajaj Finserv EMI Network Card Application Form,

- Duly signed EMI mandate

- One canceled cheque

- KYC documents, including a valid photo, PAN card, ID proof, and address proof

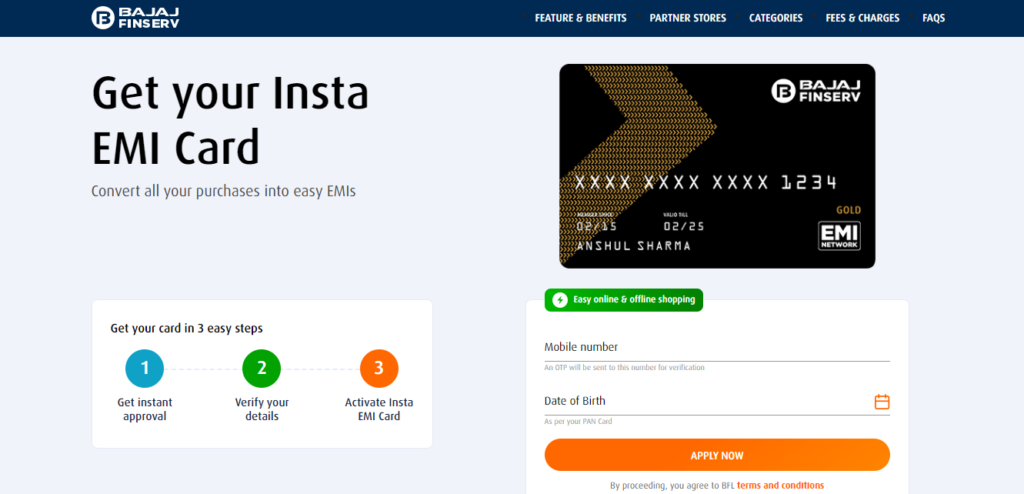

Steps to Apply for Bajaj Finserv Insta Emi Card Online

Applicants need to follow the below-given steps to apply for the Finserv Insta Emi Card online

- First of all, go to the official website of the Bajaj Finserv Insta Emi Card

- The homepage of the website will open on the screen

- Under the EMI Network option, click on the EMI Card

- Bajaj Finserv Insta Emi Card page will open on the screen

- Now, enter your Mobile Number and the Date of Birth

- After that, click on the Apply Now button

- Once you will click on the Apply now button, an OTP will be sent to your registered mobile number

- Enter the received OTP in the specified space for verification

- A new page will open on the screen

- Now, enter the following details as per the PAN Card

- Name

- PAN CARD Number

- PIN Code of your City,

- Email Address

- Gender

- Finally, click on the Get Instant Approval button

Steps to Apply for Bajaj Finserv Insta Emi Card Offline

Applicants need to follow the below-given steps to apply for the Emi Card offline:

- First of all, visit any Bajaj Finserv EMI Network partner store

- After that, choose the item you want to purchase

- Now, Inquire with a store official about activating the in-store financing option

- To set up your Bajaj Finserv EMI Network Card, fill out the Bajaj Finserv in-store financing application form

- Finally, submit the application form along with the required documents to the Bajaj Finserv EMI Network officials

Charges

The charges related to the Finserv EMI Network Card are summarised in the table below.

| Particulars* | Minimum | Maximum |

| Processing Fee | NIL | Rs. 1017 (Inclusive of taxes) |

| Penal Interest | 4% per month on the monthly installment from the date of default to the receipt of the monthly installment | |

| Bounce Charges | Rs. 450 (inclusive of taxes) | |

| CIBIL TransUnion Report Fees | Rs. 36 (inclusive of taxes) | |

| Document/ Statement Charges | l NIL – If you download from the Customer Portal – Experia l Rs. 50 (inclusive of taxes ) – if you get a physical copy from one of the Bajaj Finserv branches |

EMI Card Statement

The user needs to follow the below-given steps to get a statement for your Bajaj Finserv EMI Network Card.

- First of all, go to the Bajaj Finserv Customer Portal

- The login page will open on the screen

- Enter your user ID and password to get logged in to your registered account

- Now, click on the EMI Card section

- After that, click on the e-statement request

- Alternatively, you can obtain a physical copy of your EMI Network Card statement by visiting your nearest Bajaj Finserv branch.

Procedure to use Bajaj Finserv EMI Card for shopping

There are various ways to use the Bajaj Finserv EMI Card for shopping. The various methods to use the Bajaj Finserv EMI Card for shopping are as follows:

Method 1: Bajaj Finserv EMI Store:

- Select your city from the EMI online store

- Choose the item you want to purchase

- To purchase the product, log in to the Experia portal

- After that choose an appropriate EMI option

- Within 24 hours, the order will be delivered to your registered address.

Method 2: Obtaining a Product from a Partner Store

- First of all, visit a local partner store.

- Choose the item you want to purchase.

- To make the payment, swipe your Bajaj Finserv EMI Network Card.

Procedure for Checking the Status of a Bajaj Finserv Insta Emi Card

There are various Procedures for checking the status of a Bajaj Finserv Insta Emi Card. The various methods for checking the status of a Emi Card are as follows:

- Through Bajaj Finserv Customer Portal:

- First of all, go to the Bajaj Finserv Customer Portal

- Now, Enter your customer ID, mobile number, e-mail address, and password to get logged in to your registered account

- You can also log in with your Facebook or Google credentials.

- Once you are successfully logged in, Go to the “My Relationship” section

- After that, click on the EMI Network Card option to check the card’s status, number, expiration date, etc.

- Through Bajaj Finserv Wallet App

- Using the Bajaj Finserv Wallet App as a second option

- Go to the Google Play Store or the Apple iTunes Store and download the Bajaj Finserv Wallet App.

- Launch the app and enter the one-time password (OTP) sent to your registered phone number.

- In the top right corner, click the “Know More” tab.

- To check the card details, including the status, enter your date of birth and click See EMI Card Now.

Contact Us

For further details or in case of any query or complaint related to the Bajaj Finserv Insta Emi Card, feel free to contact on the below-given details:

- Missed call service: You can get quick information about your last three transactions with Bajaj Finserv by dialing +91 98108 52222 from your registered mobile number.

- Whatsapp: You can subscribe to Bajaj Finserv’s WhatsApp service to receive updates on your phone. To sign up, make a missed call from your registered mobile number to 8506889977.

- Phone: You can reach us at 0869-801-0101 for any questions.

- E-mail: You can also send an e-mail to Bajaj Finserv with your question.

- Virtual Assistant BLU: To get answers to common questions, you can use the Bajaj Finserv chat bot BLU.

FAQ’s

The minimum age requirement to apply for Bajaj Finserv Insta Emi Card is 21 years

The interest rate on a Bajaj Finserv EMI Network Card is determined by the product and store from which it is purchased. Although many of the goods are available on a “No Cost EMI” basis, others may have a nominal interest rate based on the Bajaj Finsev agreement.

You can pay back your Bajaj Finserv EMI Network Card loan over a period ranging from 3 months to 2 years, depending on your needs.