Pradhan Mantri Vaya Vandana Yojana Online Registration | Pradhan Mantri Vaya Vandana Yojana Application Form | PMVVY Scheme | Pradhan Mantri Vaya Vandana Yojana Interest Rate

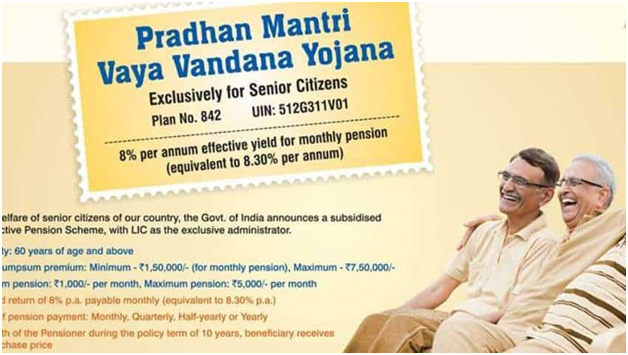

The LIC Pradhan Mantri Vaya Vandana Yojana is a pension scheme for senior citizens over the age of 60 that guarantees a pension for ten years. The majority of the time, senior citizens keep their retirement funds in risk-free zones. They don’t want to put their money at risk in uncharted territory. To ensure a steady income after retirement, they put their money in the post office, government-sponsored schemes, or bank fixed deposits. One such policy is the LIC Pradhan Mantri Vaya Vandana Yojana, which guarantees higher fixed interest rates to senior citizens.

In May of last year, the Centre launched the LIC PMVVY. The guaranteed rates of pension for policies sold during a year will be reviewed and decided by the Ministry of Finance at the start of each year, according to the terms and conditions of this plan.

For the first fiscal year, the scheme guarantees a monthly interest income rate of 7.40 percent. This guaranteed rate of pension will be paid for the full policy term of ten years for all policies purchased until March 31, 2022.

Table of Contents

Pradhan Mantri Vaya Vandana Yojana (PMVVY)

The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is an annuity program. The scheme guarantees a pension payout at a set rate for ten years. Furthermore, at the end of the ten-year policy term, the purchase price will be refunded. The PMVVY is a pension scheme for senior citizens over the age of 60 that guarantees a pension for ten years. In May of last year, the Centre launched the LIC Pradhan Mantri Vaya Vandana Yojana. The guaranteed rates of pension for policies sold during a year will be reviewed and decided at the start of each year, according to the terms and conditions of this plan.

Validity of PMVVY

The Pradhan Mantri Vaya Vandana Yojana is still accepting applications until March 31, 2023. The Life Insurance Corporation of India manages this pension plan (LIC). This pension scheme is available both offline and online through the LIC website, www.licindia.in.

Eligibility criteria of Pradhan Mantri Vaya Vandana Yojana

The following is the eligibility criteria for applying for the Pradhan Mantri Vaya Vandana Yojana:

- The applicant must be a senior citizen over the age of 60 i.e the aplicant’s age should not be below 60 years.

- There is no upper age limit for participating in the PMVVY Scheme.

- The subscriber must possess an Indian citizenship.

- The subscriber must be willing to commit to a 10-year policy term.

- In the case of monthly pension, the minimum purchase price is Rs 1.50 lakh. That is, in order to participate in the Pradhan Mantri Vay Vandana Yojana, an investment of at least Rs 1.50 lakh must be made in a year.

- A person can only invest up to Rs.15 lakh in the scheme. This means that the scheme can only accept investments of up to 15 lakh rupees.

Documents Needed for PMVVY

The following documents are required to subscribe to the PMVVY:

- The Aadhaar Card

- Age Verification

- Address proof

- A passport-sized photograph

- Documents proving the applicant’s retirement from employment

Benefits & Features of Pradhan Mantri Vaya Vandana Yojana

The key features and benefits of the PMVVY Scheme are as follows:

- The PMVVY scheme guarantees subscribers a 7.40 percent annual rate of return for the fiscal year 2020-21, which will be reset every year thereafter.

- The pension will be paid at the end of each period in accordance with the payment mode selected by the pensioner at the time of purchase.

- Annual reset of the assured rate of interest with effect from April 1st of each fiscal year in line with the revised rate of returns of the Senior Citizens Saving Scheme up to a ceiling of 7.75 percent, with a fresh appraisal of the scheme if this threshold is breached at any time. During the policy term of ten years, the pension will be paid to the pensioner in arrears.

- After three policy years, a loan of up to 75 percent of the purchase price can be obtained to cover emergencies.

- The early exit allowed for treatment in the event of a medical emergency or critical illness in oneself or one’s spouse. 98 percent of the purchase price is refunded in this case.

- The maximum pension is set per senior citizen, i.e. the total amount of pension available under all policies under this plan.

- In the event of the pensioner’s death during the 10-year policy term, the purchase price will be refunded to the beneficiary/nominee.

- If the pensioner survives, the purchase price and the final annuity installment will be returned to the pensioner as a maturity benefit.

- The scheme is exempt from the Goods and Services Tax (GST) (GST).

Min & Max Pension under Different Modes of Pension

| Mode of Pension | Minimum Pension Amount | Maximum Pension Amount |

| Yearly | Rs. 12,000 per annum | Rs. 1,20,000 per annum |

| Half-Yearly | Rs. 6,000 per half-year | Rs. 60,000 per half-year |

| Quarterly | Rs. 3,000 per quarter | Rs. 30,000 per quarter |

| Monthly | Rs. 1,000 per month | Rs. 10,000 per month |

The maximum pension is set per senior citizen, i.e. the total amount of annuity available under all policies under this plan.

Post Office Monthly Income Scheme (POMIS)

Minimum Purchase Price

The minimum investment in the scheme required to receive a monthly pension of Rs.1000 is Rs.1, 62,162/-. The scheme requires a minimum investment of Rs.1, 56,658/- to receive a minimum pension of Rs.12, 000/- per year.

Application Procedure forPradhan Mantri Vaya Vandana Yojana (PMVVY)

This plan is available to senior citizens for a one-time payment of a lump sum. It is available for purchase both offline and online. There are two ways to enroll in the PMVVY program:

1. Online Procedure

2. Offline Procedure

Online Process to Purchase PMVVY

In order to purchase PMVVY online, follow the steps outlined below:

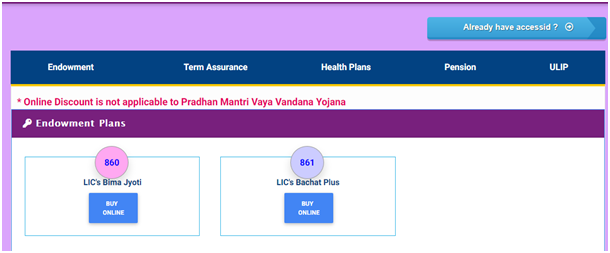

- First of all, go to the LIC’s official website i.e licindia.in.

- Click on ‘Click here to buy option’ under the BUY POLICY ONLINE Tab.

- Now another external window will open. Here you need to click on ‘Pension’ option

- Now click on Buy online – PMVVY 856 option.

- Now on another page, click on ‘CLICK TO BUY ONLINE’ option. This will open a form before you. You need to fill this form by filling the appropriate details such as no, phone number, date of birth, and email ID and then click on the option “Calculate Premium”.

- Next you will receive an OTP on your mobile, fill it on the next screen and click on the “PROCEED” button.

- After carefully entering all the details, select “Purchase Option”, “Pension Mode”, “Amount” and “Payment Mode” etc.

- Then click on the “Calculate Premium” button.

- You will be informed about the premium in the following steps, and you will be required to enter your Aadhaar number and make an online payment. Following the successful payment, you will be given the policy number and the entire policy document will be sent to your email address.

Under the Pradhan Mantri Vaya Vandana Yojana, you can choose from monthly, quarterly, half-yearly, or annual pension options.

PMVVY Pension Plan

- PMVVY scheme is available for a period of ten years.

- This PMVVY scheme is exempt from GST and service tax.

- The pensioner has the option of receiving payments monthly, quarterly, half-yearly, or annually.

- The purchase price will be paid with the final installation after ten years.

- After three years of the policy, policyholders will be able to borrow up to 75% of the purchase price.

Tax Exemption under Pradhan Mantri Vaya Vandana Yojana (PMVVY)

- This scheme’s investment is not tax-free. The policyholder must pay income tax on the interest earned on the deposited amount.

- If you want to increase your pension every month, the interest rate in 2020-21 will be 7.4 percent. If the entire amount of the pension is increased once a year, the same interest rate rises to 76.6 percent.

- The scheme’s investment limit is per senior citizen, not per family. If the husband and wife so desire, they can each invest 30 lakh rupees.

- The policy has a 10-year term. You canchoose to receive your pension payments either monthly or quarterly or semi-annually or annually.

- There is no need for a medical examination for policyholders to receive benefits under this scheme.

- Under the Pradhan Mantri Vaya Vandana Yojana, you can choose from monthly, quarterly, half-yearly, or annual pension options.

- If you put in 1 lakh 50 thousand rupees in this scheme and want a monthly pension, you can do so. You will be paid 1,000 rupees per month in this case.

- After ten years of investing in the scheme, the deposit is also returned along with the final payment of pension. If the pensioner’s death plan dies within the first ten years of purchasing the policy, the purchase price (deposit amount) is refunded to the designated person.

- Previously, the amount invested in PMVVY was lower, but it has now been increased to 15 lakhs. If you invest Rs 15 lakh, you will receive a monthly pension of up to Rs 10,000.

Contact

If you have any queries related to PMVVY Scheme, feel free to contact me at the below mentioned phone number. You can also mail at the email ID mentioned below.

| Call us | Timing |

| 022-67819281 | Monday to Saturday From10.30 am to 05.30 pm |

| 022-67819290 | (2nd and 4th Saturday of every month are holidays) |

| Email – onlinedmc@licindia.com |

FAQ’s

The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a government-sponsored pension scheme for senior citizens aged 60 and up.

The Life Insurance Corporation of India will administer PMVVY on behalf of the Government of India.

This Scheme is available for purchase until March 31, 2023.

This Scheme is available to Indian senior citizens aged 60 years (completed) and above.

There is no maximum age for purchasing this Scheme.

This Scheme has a 10-year term.

Pension payments can be made monthly, quarterly, semi-annually, or annually. The first installment of pension shall be paid after 1 year, 6 months, 3 months, or 1 month from the date of purchase, depending on the mode of pension payment chosen, i.e. yearly, half-yearly, quarterly, or monthly.

The scheme provides the following benefits:

Pension Payment: If the Pensioner survives the policy term of ten years, he or she will be entitled to a pension in arrears (payable at the end of each period, depending on the mode chosen). For example, if you select a monthly annuity, the first pension payment will be made one month after the date of purchase.

Death Benefit: If the Pensioner dies during the 10-year policy term, the Purchase Price will be refunded to the beneficiary.

Maturity Benefit: If the pensioner lives to the end of the policy term of ten years, the purchase price, along with the final pension installment, will be paid.

A policy purchased under this policy may be surrendered at any time during the policy’s term under exceptional circumstances, such as the Pensioner’s need for money to treat a critical/terminal illness in himself or herself or that of a spouse.

The Surrender Value payable under this Scheme is 98 percent of the Purchase Price.

After three policy years, a loan facility is available. The maximum loan amount that can be granted is 75% of the Purchase Price.

The rate agreed upon at the time of policy purchase will remain constant for the entire ten-year policy term. Thus, the rate of interest for policies purchased during the fiscal year 2020-21 will be 7.40 percent p.a. payable monthly (equivalent to 7.66 percent p.a.) for the full term of ten years.

According to the Ministry of Finance’s review, the Scheme will continue to provide an assured pension of 7.40 percent p.a. payable monthly (equivalent to 7.66 percent p.a.) for policies sold during the Fiscal Year 2021-22. This guaranteed rate of pension will be paid for the full policy term of ten years for all policies purchased until March 31, 2022.

According to the terms and conditions of this Scheme, guaranteed rates of pension for policies sold during a year will be reviewed and decided by the Ministry of Finance, Government of India, at the start of each year.

The Scheme will provide an assured pension of 7.40 percent p.a. payable monthly for the first fiscal year, i.e. up to March 31, 2021. The rate of guaranteed pension in the previous version of PMVVY was 8.00 percent p.a., payable monthly.

The guaranteed pension rate is the same whether purchased offline or online.

The Scheme will provide an assured rate of return of 7.40 percent p.a. payable monthly for Policies sold up to 31.03.2021. (I.e. equivalent to 7.66 percent p.a.). The applicable assured rate of interest, at which the pension payment shall be made, for policies sold during the next two fiscal years will be reviewed and decided at the beginning of each fiscal year by the Ministry of Finance, Government of India.

According to the Ministry of Finance, Government of India’s review of the assured rate of return for the Fiscal Year 2021-22, there is no change in the assumed rate of return at which pension payments will be made. As a result, the Scheme will continue to provide an assured pension of 7.40 percent p.a. payable monthly (equivalent to 7.66 percent p.a.) for all policies purchased under the Scheme until March 31, 2022. This guaranteed rate of pension will be paid for the full policy term of ten years for all policies purchased until March 31, 2022.

The loan interest will be deducted from the policy’s pension amount. The loan interest will accrue in accordance with the policy’s frequency of pension payment and will be due on the pension’s due date. The outstanding loan, however, must be recovered from the claim proceeds at the time of exit.

.